Table of Contents

Toggle1. Introduction

This article presents SWOT analysis of Walmart by scanning the company’s internal and external business environment. Walmart strengths and weaknesses are analyzed, and threats and opportunities are assessed to the evaluate company’s competitive positioning in the market.

2. What type of business is Walmart?

Walmart is a U.S.A based multinational retailer that operates supermarkets, grocery stores, hypermarkets, neighborhood markets and discount stores.

3. Company Overview

| Company | Walmart |

| Industry | Retail |

| Key operations | Retail and e-commerce by sourcing products from more than 100 countries |

| Number of countries | 24 |

| Revenue 2022 | $573 billion |

| Key competitors | Costco, Target, Amazon, Kroger, Carrefour |

4. Walmart SWOT Analysis 2022

4.1. Walmart Strengths and Weaknesses – Internal Analysis

4.1.1. Walmart Strengths

Here are some key business strengths of Walmart:

1. Strong competitive positioning

Walmart holds strong competitive positioning against its competitors. Here is comparison of Walmart against top five competitors:

Walmart competitor analysis- 2022

| Walmart | Costco | Carrefour | Kroger | |

| Revenue | $600.1 billion | $226.9 billion | $87.8 billion | $137.8 billion |

| Number of countries | 24 | 12 | 30 | 1 |

| Employees | 2,300,000 | 304,000 | 319,565 | 420,000 |

| Net worth | $382.38 billion | $202.64 billion | $12.28 billion | $31.94 billion |

Source: Macro Trends1|Macro Trends2|Macro Trends3|Macro Trends4

2. Dominance in brick and mortar retailing

Walmart has strong dominance in brick-and-mortar retailing, due to which it remains unbeaten by Amazon, particularly in rural areas.

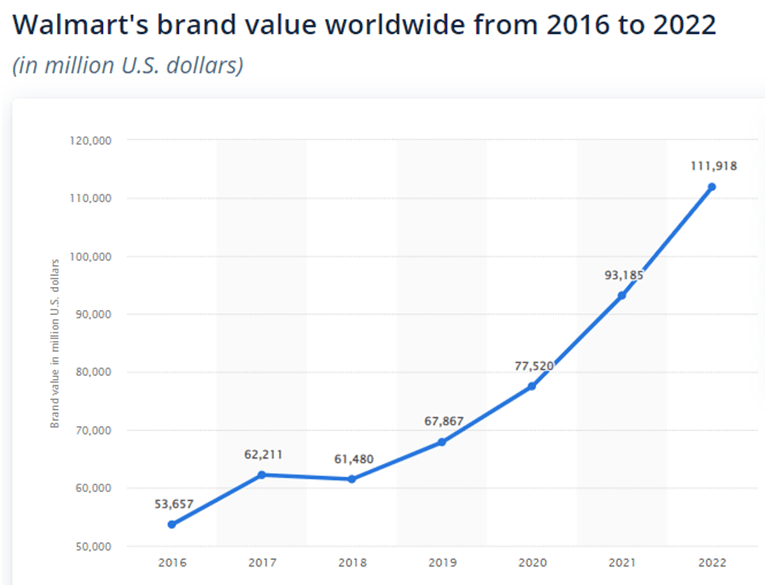

3. Brand value

Walmart is among world’s most valuable brands. Following graph shows consistent rise in Walmart’s brand value from 2016 to 2022:

Source: Statista

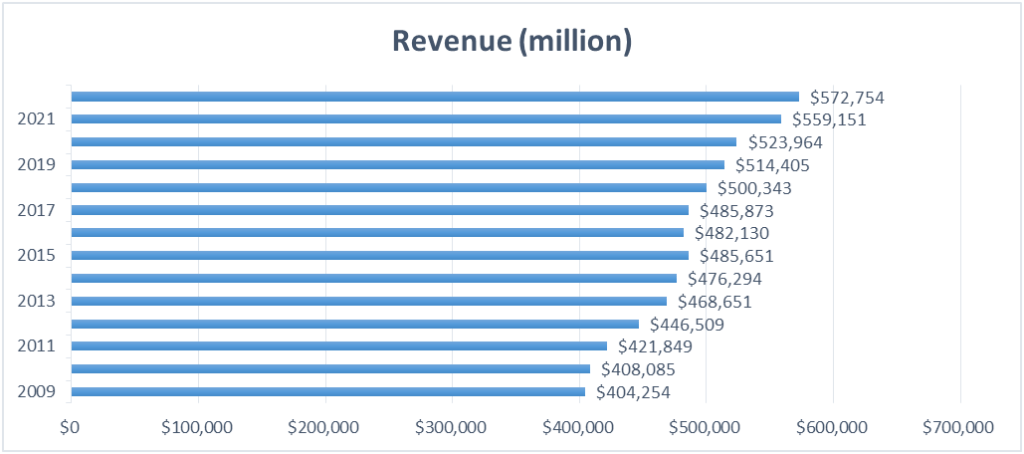

4. Consistent revenue growth

Despite the challenges, company is able to ensure consistent revenue growth from 2009 to 2022:

Walmart revenue growth – 2009-2022

Source: Macro-Trends

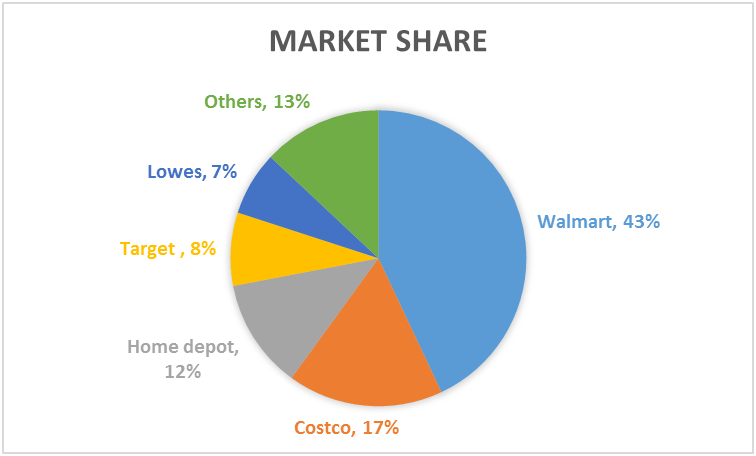

5. Strong positioning in the market

Walmart has a huge size with wide market reach, which enables it to exercise strong market power over competitors and suppliers.

6. High market share

Walmart competitive analysis suggests that Walmart holds strong leadership position with high market share relative to competitors:

Source: CSI Market

7. Effective e-commerce platform

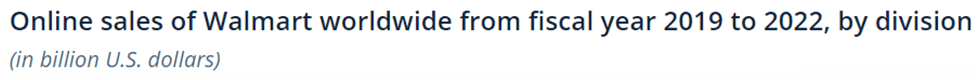

After establishing strong foothold in brick and mortar market, Walmart is strengthening its presence in e-commerce sector as well in all key business segments, as depicted in following graph:

Source: Statista

8. Investment on technology and innovation

Walmart is heavily investing on technology and innovation to offer customer convenience. Some latest initiatives include-

- Added symbotic robots to 25 distribution centers, deployed robot janitors and shelf checking robots in stores

- Launched Roblox store as a first foray into meta-verse

- Investing on augmented reality features to enhance online shopping experience

9. Strong distribution network

Walmart has a wide network of highly automated distribution centers. Strong logistics system is company’s core competence. Walmart shares strong relationship with manufacturers/suppliers and distributors. The robust supply chain strategy enables company to minimize supply chain disruptions and reduce costs.

10. Walmart economies of scale

Walmart is the cost leader in global retail industry. The company achieves economies of scale by spreading fixed costs over thousands of products, and then translates low costs into low prices.

After analyzing key strengths of Walmart, now lets’ analyze some weaknesses of Walmart:

4.1.2. Walmart Weaknesses

Here are some key Walmart weaknesses:

1. Low customer satisfaction

Compared to competitors, Walmart earns low customer satisfaction score. American customer satisfaction index ranked Walmart ‘70’ in 2021 (-1% compared to 2020), which is lower than many of its competitors in USA.

2. Over dependence on the home market

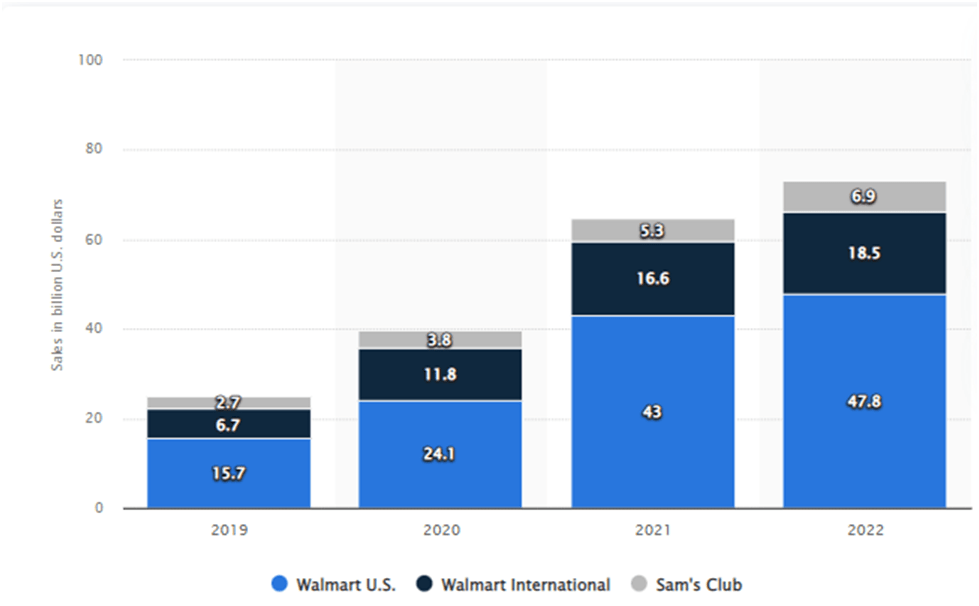

Walmart excessively relies on home market. Following graph shows that in 2022, Walmart earned $393 billion revenue from USA, and only $175 billion revenue from other world regions.

Source: Statista

3. Ineffective inventory management system

Walmart is facing excessive inventory management issues due to poor inventory accounting. According to Forbes, the last-in-first-out inventory accounting method along with demand fluctuations for high and low margin items is causing inventory pileup.

4. Ineffective human resource management

Walmart faces high employee dissatisfaction due to excessive job stress, poor job quality and low wages, which results into whopping 70% employee turnover rate.

5. Sustainability challenges

Despite the commitment to ensure sustainability, Walmart fails to minimize the hazardous impact on environment. Forbes noted that Costco emits 50 percent fewer emissions than Walmart, while Walmart remains unable to achieve its sustainability objectives.

6. Lack of diversity and inclusion

Business Insider reported that at start of pandemic, Walmart fired its black employees twice than its white employee, and in 2021, black employees only accounted for 21% of total workforce.

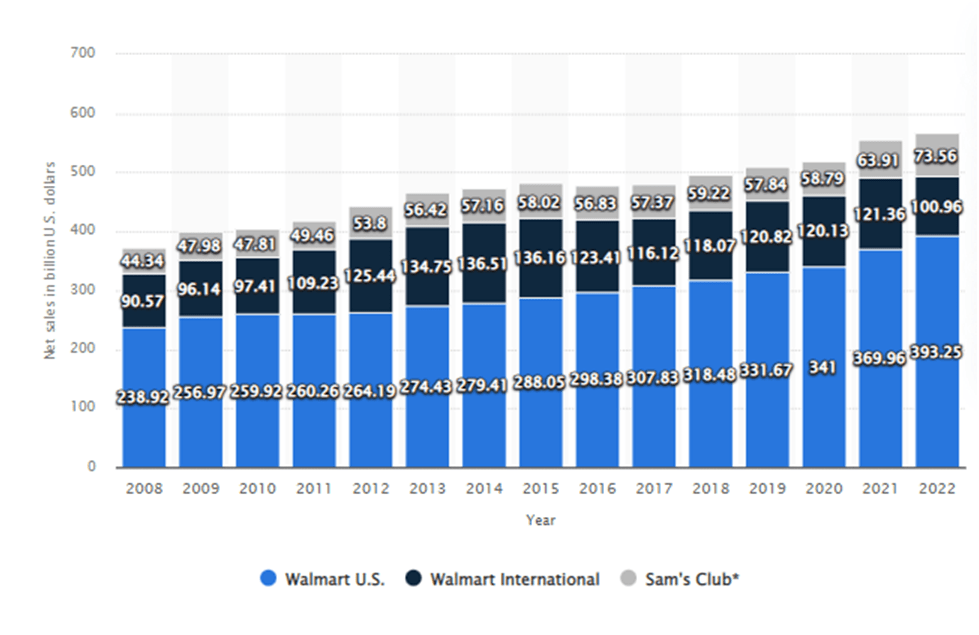

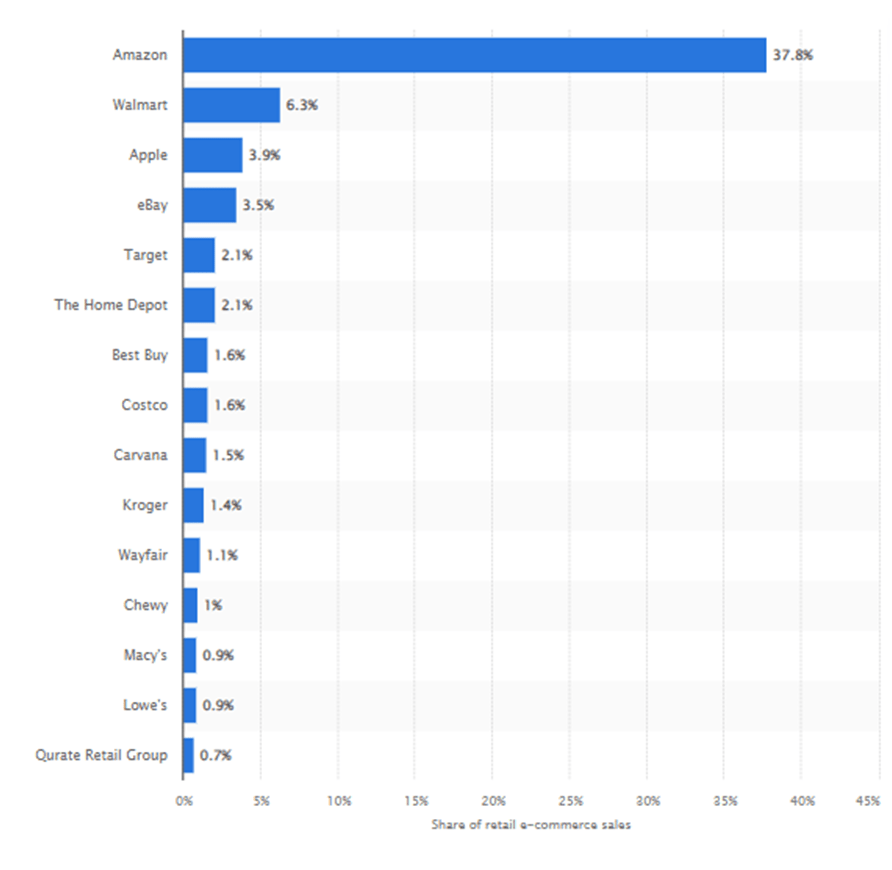

7. Weak presence in online market

Although, Walmart’s online sales are consistently growing, but Walmart holds weak competitive positioning in ecommerce sector than global e-commerce giants. Following graph shows Walmart holds only 6.3% market share in ecommerce compared to Amazon that holds 37/8% share:

Source: Statista

8. Outdated business model

Walmart needs to rebrand itself by making its business model more tech savvy. Current business model is diversified, but can be easily imitated by competitors due to its simplicity. Historically, Walmart was able to keep prices low through low wages and cheap sourcing. But cannot continue cheap prices without business model re-branding.

After analyzing Walmart strengths and weaknesses, now let’s analyze external environment of Walmart.

4.2. Walmart Opportunities and Threats- External Analysis

4.2.1. Walmart opportunities

1. Global expansion through e-commerce

Walmart should expand its operations in the emerging markets, particularly in the e-commerce sector. The analysts predict Asia Pacific region ($3.3 trillion sales in 2022) will be having highest e-commerce growth, followed by North America ($1.15 trillion), and Western Europe ($695 billion).

2. Expand healthcare clinics

Walmart should expand its healthcare services in 2023 to tackle the competition from Amazon who plans to increase revenue from healthcare segment. Currently, Walmart has only 32 clinics in only five states within USA.

3. Automation and robotics

Walmart can invest on robotics and automation to resolve its labor and inventory management issues, which are affecting the company’s profitability.

4. Increase presence in Meta-verse

As per Forbes, Meta-verse in retail will make shopping experience more meaningful and engaging. Walmart seems well-prepared for this opportunity, as it has already partnered with Roblox to venture into Meta-verse.

5. Expand financial services

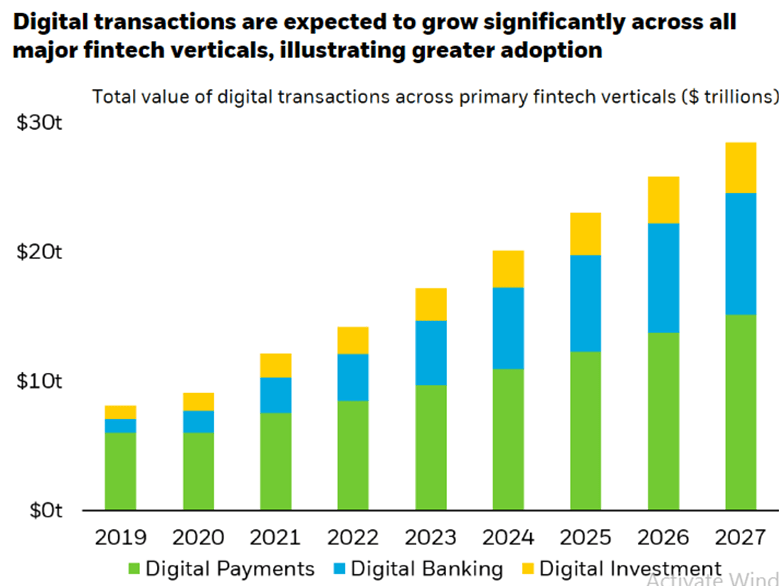

Walmart has entered in fin-tech market. Analysts expect global fin-tech industry is expected to growth with 25% CAGR from 2022 to 2027:

Source: iShares.com

Considering the rising inflation and its impact on consumer spending, Walmart can expand its financial services by launching more fin-tech firms that offer ‘buy now, pay latter’ options to the customers.

4.2.2. Walmart threats

1. Trade tensions

Growing US-China trade tensions have now started directly affecting the Walmart’s business operations.

2. Economic downturn

The forecasts suggest U.S economy will slow-down, and real GDP growth will be close to zero in 2023. Rising inflation is affecting consumer spending, and this economic downturn is affecting profitability of retail giants including Walmart.

3. Intensifying competition in e-commerce

Small and medium companies are likely to give tough competition in the e-commerce sector. Walmart’s weak presence in ecommerce (compared to competitors) increases its vulnerability to this threat.

4. Law suits

Walmart faces around 5,000 lawsuits each year, mostly by its employees that bring discrimination, and wage and hour claims. In 2022, Walmart paid $3.1 billion to settle opioid lawsuits. Inability to manage and respond to the lawsuits could intensify this threat and affect company’s reputation and economic performance.

5. Summary – SWOT of Walmart

Wal Mart SWOT analysis

| Strengths • Strong competitive positioning • Brick and mortar dominance • High brand value • Consistent revenue growth • Strong competitive positioning • High market share • Effective e-commerce platform • Investment on technology and innovation • Strong distribution network • Walmart economies of scale | Weaknesses • Low customer satisfaction • Over reliance on home market • Inventory management issues • HR issues • Sustainability challenges • Lack of diversity and inclusion • Weak presence in online market • Outdated business model |

| Opportunities • Global expansion • Expand healthcare services • Automation and robotics • Increase presence in • Meta-Verse • Expand financial services | Threats • Trade tensions • Economic downturn • Intensifying competition • Lawsuits |

6. Recommendations based on Walmart SWOT Analysis 2022

• Expand business operations to emerging markets to reduce reliance on home market

• Improve human resource management practices by adopting clear anti-discrimination policies

• Respond to lawsuits by strengthening the monitoring and control mechanisms

• Improve image on sustainability grounds by adopting environment friendly practices and reducing emissions

• Strengthen presence in the e-commerce sector by deploying latest technology and capabilities

• Invest more on augmented and virtual reality to offer more engaging online shopping experience

• Improve inventory management system by investing on automation

• Make business model more tech-savvy by accelerating the digitalization process

• Expand healthcare and financial services through collaborations and partnerships

7. Concluding remarks

Walmart’s strong dominance in brick and mortar market shields it from aggressive competition. Highly efficient logistics network and strong bargaining power against suppliers are key strengths that allow Walmart to achieve economies of scale. But labor and supply chain issues are some key weaknesses that need to be addressed. Company needs to further invest on emerging technologies to reduce costs and enhance efficiency besides augmenting the customer experience.

If you want to know more about Walmart marketing strategy, click here (internal linking previous article).

8. References

Walmart Revenue 2010-2022 | WMT. (n.d.-b). MacroTrends.

Costco Revenue 2010-2022 | COST. (n.d.). MacroTrends.

Carrefour SA Revenue 2010-2022 | CRRFY. (n.d.). MacroTrends.

Kroger Revenue 2010-2022 | KR. (n.d.). MacroTrends.

Statista. (2022a, March 25). Walmart: global brand value 2016-2022.

Walmart Revenue 2010-2022 | WMT. (n.d.-c). MacroTrends.

Walmart Inc Market share relative to its competitors, as of Q3 2022 – CSIMarket. (2022, December 30).

Statista. (2022a, March 25). Walmart: eCommerce sales worldwide FY2019-FY2022, by division.

The American Customer Satisfaction Index. (2022, June 20). Supermarkets.

Statista. (2022d, July 27). Walmart: net sales worldwide FY2008-FY2022, by division.

Banker, S. (2022b, August 17). Walmart’s Supply Chain Woes. Forbes.

Monroe, M. (2022, January 27). How a large employer’s low-road practices harm local labor markets: The impact of Walmart Supercenters. Equitable Growth.

Bansal, T. (2021, December 20). Walmart Appears To Be Greener Than Costco. But Is It Really? Forbes.

Walmart fired Black hourly employees twice as often as their white coworkers at the pandemic’s start, congressional report says. (2022, November 21). Business Insider.

Statista. (2022i, August 26). Biggest online retailers in the U.S. 2022, by market share.

Statista. (2022o, December 21). Retail e-commerce sales value worldwide 2022, by region.

Kestenbaum, R. (2022, March 16). What The Metaverse Means For The Future Of Retail. Forbes.

Maruf, R. (2022, September 26). Walmart enters the metaverse with Roblox experiences. CNN.

Ltd, M. D. F. (n.d.). Market Data Forecast | Research Reports and Business Insights. Market Data Forecast.

Blocked. (n.d.).

Zois, M. A. &. A. L. (2023, January 11). Walmart Store Settlements and Lawsuits.

Access Denied. (2022, November 15).