Table of Contents

ToggleAbstract

This article presents the Tesco SWOT analysis. In-depth internal and external environmental analysis highlights key strengths and weaknesses that Tesco must consider while pursuing external opportunities, and mitigating threats. Strategic marketing and management students, researchers and retail managers- all may read this article to understand the changing retail industry dynamics.

1. Introduction

Tesco holds the highest market share in UK. At international stage, Tesco is considered among world’s top ten largest retailers. Although, Tesco holds strong leadership position in home market, but recently, company is not performing well at international level.

In this article, we have conducted an in-depth internal and external environmental analysis of Tesco. The analysis highlights key internal and external factors that influence the Tesco’s competitive positioning in the market.

To get an overview of latest company information, click here.

2. Tesco SWOT Analysis

2.1. Strengths of Tesco

2.1.1. Market share

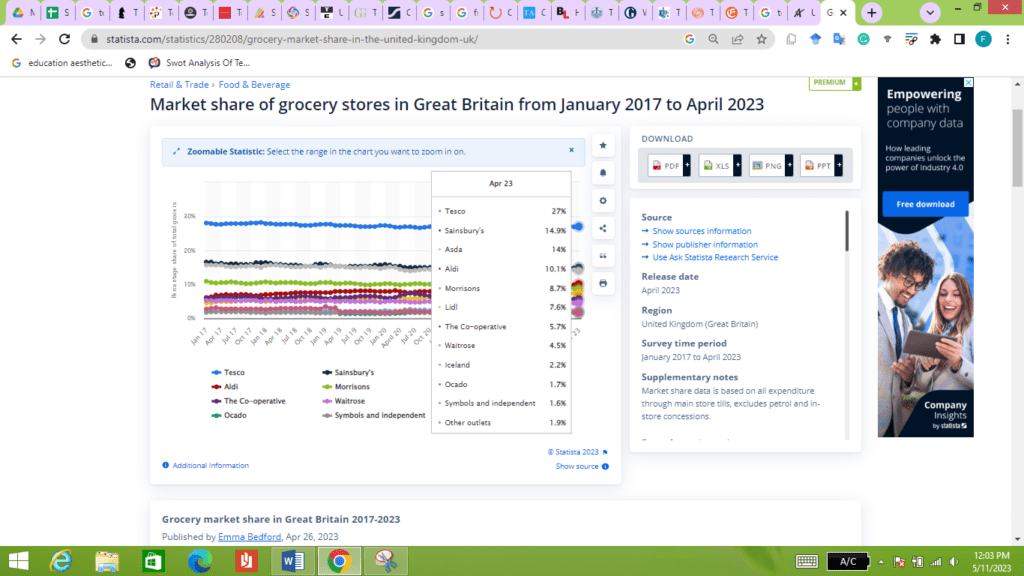

Tesco has consistently maintained its market share despite intense competition. The retail giant has only lost 1% market share since 2017.

Following graph shows that Tesco is clearly above other retailers, holding 27% market share, followed by Sainsbury (14.8%), and Asda (14%):

Source: Statista

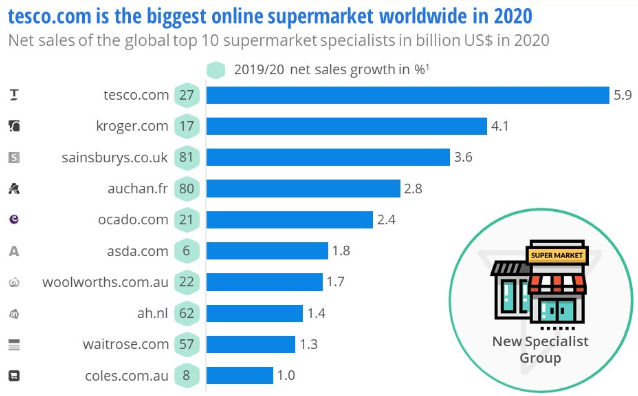

2.1.2. Strong e-commerce growth

Tesco recorded strong e-commerce growth. In 2023, Tesco’s online sales are 59% above the pre-pandemic online sales level. Tesco is UK’s #1 online supermarket. In 2020, Tesco became world’s biggest online supermarket, as depicted in following graph:

Source: Ecommercedb.com

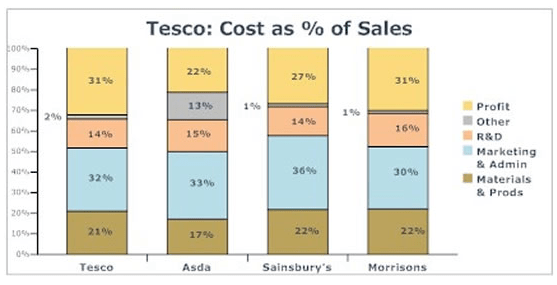

2.1.3. Low production cost

Tesco has successfully kept its production cost lower than competitors, as depicted in following graph:

Source: E-commerce Digest

2.1.4. Supply chain resilience

Tesco has developed strong partnerships with its suppliers. In 2021, the strong supplier partnerships enabled Tesco to record 16.6% profit growth, while its competitors struggled with supply chain disruptions and labor shortages.

2.1.5. Wide market reach

Tesco has wide market reach in its home market. In 2023, Tesco has 4,074 stores of various types and formats that target diverse market segments.

2.1.6. Well-managed portfolio

Tesco has a well-diversified portfolio that protects company from environmental uncertainty. Tesco’s portfolio includes- Tesco Superstores, One Stop, Tesco Express, Tesco Extra, Tesco Metro and Tesco Home-Plus.

2.1.7. Well-developed technological infrastructure

Tesco has well-developed technological infrastructure. The company proactively invests on emerging technologies (like robotics, AR and VR), and has remained at the forefront of digital transformation in post-pandemic world.

2.1.8. Strong competitive positioning

Tesco holds strong competitive positioning in UK retail market. A report by Reuters discussed how Tesco outperformed rivals over Charismas sales in 2021, as shown in following table:

| Brands | Sales decline in 2021 compared to 2020 |

| Tesco | -0.9% (decline) |

| Sainsbury | -4.4% (decline) |

| Asda | -3.9% (decline) |

| Morrison’s | -6.5% (decline) |

2.2. Weaknesses of Tesco

2.2.1. Poor stock performance

Due to economic headwinds, Tesco share price has fallen over 30% with profits set to suffer, and its sales growth has also dropped- as reported by Bloomberg.

2.2.2. Profit stagnation

Although, Tesco’s gross sales have rose to £56.7bn, but its profits have cut to halve. For year 2022/2023, Tesco operating profit has shown a decline of 6.9%.

2.2.3. Poor food quality

Tesco is ranked as UK’s worst supermarket based on food quality after accounts of headaches, vomiting and diarrhea. High product recall rate and food poisoning allegations have put Tesco at bottom of hygiene and safety standards. In 2021, Tesco faced fine of £7.5 million for selling expired food items.

Click here to read how Tesco faced criticism when a customer discovered gnawed popcorn bag at Tesco store in 2022.

2.2.4. Poor labor practices

Tesco draws intense criticism for keeping its workers in stressful and inhumane work conditions. Tesco may face legal consequences for forcing its workers to work above 99 hours a week.

2.2.5. Poor international expansion strategy

Tesco miserably failed in Japan, primarily due to its poor knowledge of local cultural norms and values. Due to poor international expansion planning, Tesco also exited from Thailand, China and Malaysia. The disappearance from South-East Asia has made Tesco a European retailer.

2.2.6. Greenwashing and deceptive marketing practices

Tesco at often faces criticism over its deceptive and misleading advertisements. Some recent examples of poor marketing strategy include:

• 2019– Misleading customers to believe Tesco offers better value than Aldi and Lidl

• 2022– Greenwashing ad, misleading claims about the impact of Tesco plant based products on environment

• 2022– Tesco mobile advertising campaign banned for using food names as substitute for expletives.

2.2.7. Human resource challenges

In 2023, Tesco has announced its plans to cut number of team leads by 1,750, and introduce around 1800 new low-paid shift leader roles. It may affect the Tesco’s internal business operations.

2.2.8. Leadership change

In 2020, the new CEO- Ken Murphy replaced the Dave Lewis. New CEO may find it challenging to fuel the ecommerce growth.

2.3. Tesco Opportunities

2.3.1. Emerging economies

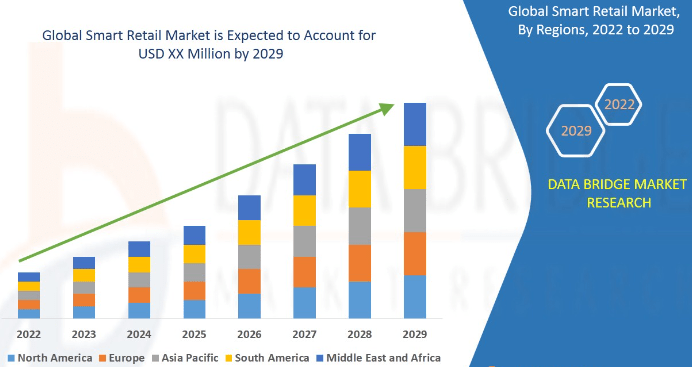

The global retail market is set for growth despite all odds. Following graph shows Middle East and African retail market present lucrative growth opportunities to retailers like Tesco:

Source: Data Bridge Market Research

2.3.2. Growing online shopping trend

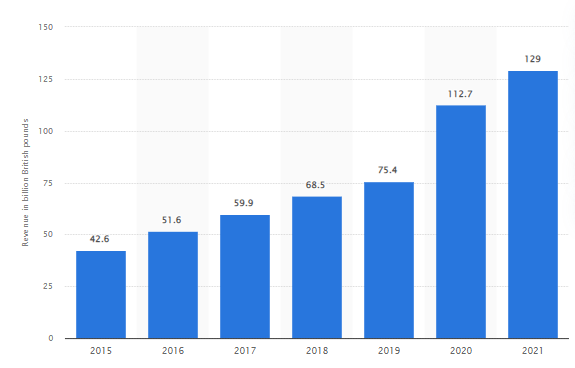

In UK, the e-commerce revenue is experiencing constant growth over 2015-2021 time period, as depicted in following graph:

Source: Statista

Tesco may take it as an opportunity, and expand its online operations both- at local and global stage.

2.3.3. Digital transformation

The post-pandemic digital transformation proved to be an opportunity to address the long-standing business challenges that were haunting global retailers. Tesco should accelerate digital transformation process across all key business areas, as it can alleviate the constant pressure to reduce costs.

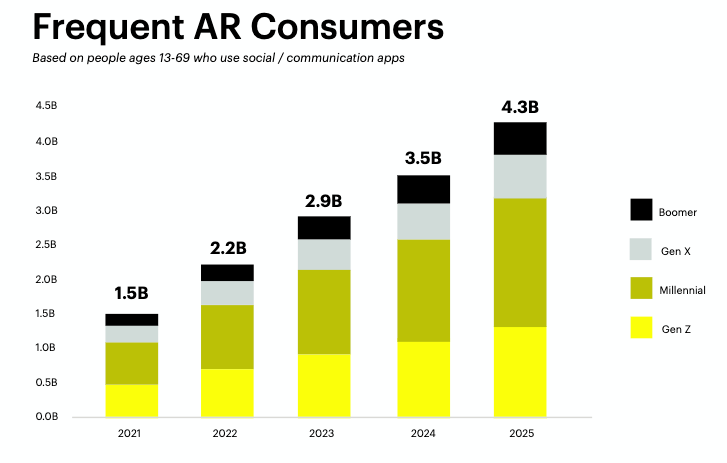

2.3.4. Trend of augmented and virtual reality

The retail industry is investing heavily on AR/VR technology to offer a realistic online shopping experience. Following graph shows the growing preferences of consumers of all age groups for AR experience:

Source: Artlabs.ai

Considering the growth of Millennial and Gen Z in global retail market, Tesco should invest more on AR/VR technology.

2.3.5. Integration of robotics technology

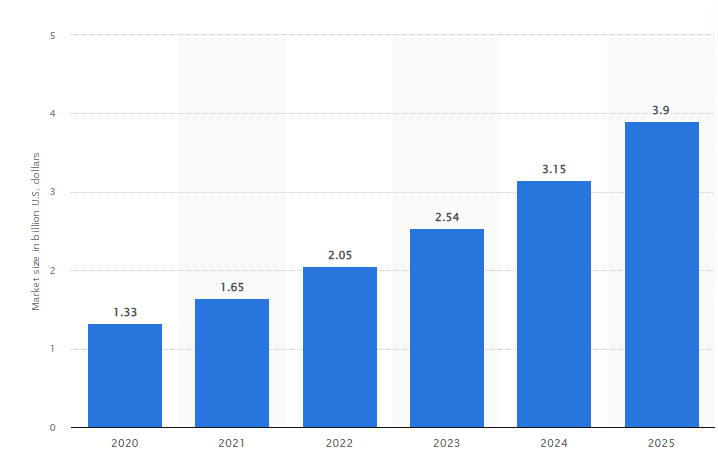

The integration of robotics technology to handle warehouse operations is growing in UK, as shown below:

Source: Statista

Tesco may increase investment on robotics to reduce supply chain disruptions, and handle labor shortage and wage inflation issues.

2.3.6. Strategic partnerships

Tesco may find new strategic partners to fuel business expansion. However, such opportunities should be availed with caution.

Recently, Tesco made a strategic alliance with Carrefour. The alliance was made with an intention to cut costs. However, it did not end well, and both partners parted their ways apart. In future, Tesco may carefully choose its strategic partners to achieve desired objectives.

2.3.7. Growing sustainability preferences

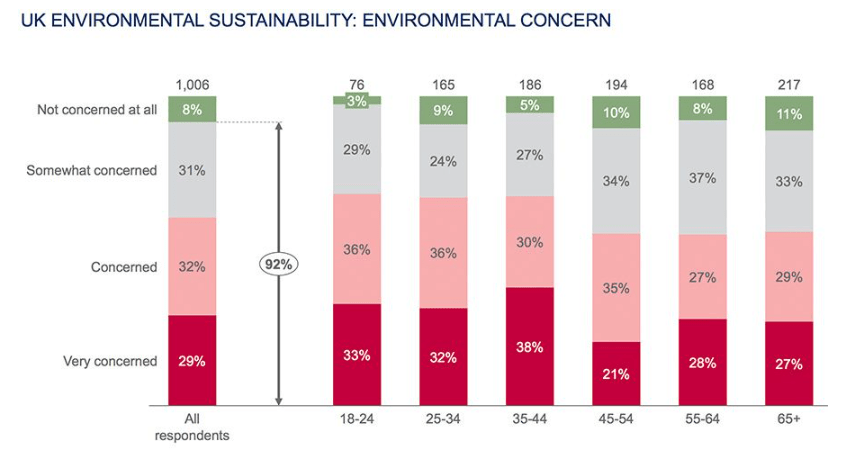

A recent study on UK consumers show 9 out of 10 retail consumers have become greener while making purchase decision. The study results are summarized below:

Source: Consultancy.UK

Tesco may invest on sustainable and green marketing efforts to positively influence the consumer behavior.

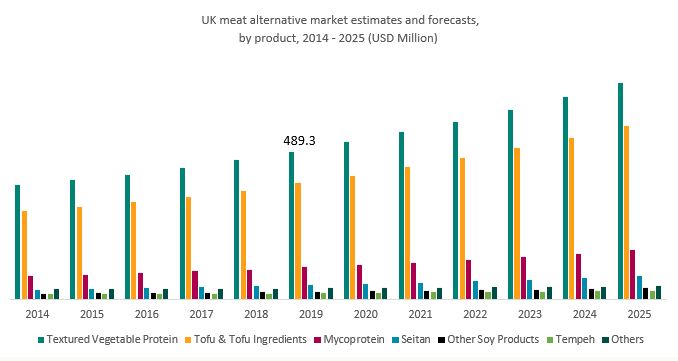

2.3.8. Growing vegan/vegetarian market

The vegan/vegetarian market is experiencing visible growth in UK, as depicted in following graph:

Source: Vegan Society

Considering the growth trend, Tesco may launch more plant based products to capture wider market share.

2.4. Tesco threats

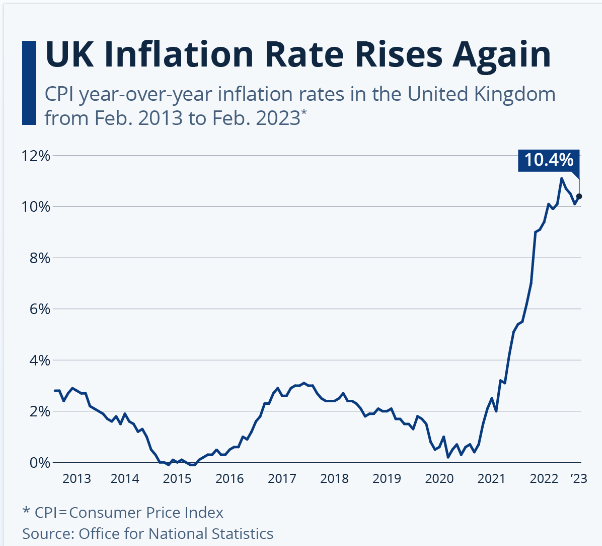

2.4.1. Economic uncertainty

Looming economic recession imposes a significant threat to Tesco. The rising inflation and reducing consumer spending in UK are negatively affecting the Tesco performance. In 2023, UK inflation has grown to 10.4%

Following graph shows a steep rise in inflation from 2013 to 2023

Source: Statista

As per BBC, Tesco sees its profits cut halve to £1 billion due to rising inflation. However, future forecasts suggest the prices will come down, and inflation will reduce in 2024 and 2025, which may have positive implications for Tesco.

2.4.2. Intensifying competition

As per Irish examiner, Tesco is unable to increase its profits despite revenue growth (7.9% growth in 2022), primarily due to rising costs and fierce competition in retail industry.

2.4.3. Lawsuits

Tesco is facing various lawsuits that are affecting its brand image. Here is the timeline of the lawsuits and controversies that Tesco faced in recent times:

2.4.4. Controversies

In 2022, various controversies surrounded Tesco that affected the brand image. Here are some examples:

• Tesco drew criticism for ‘hidden’ deforestation claims

• Tesco allowed suppliers to donate surplus food only through company shop and fare share. It prevented a wider charity net

• Tesco plant based food advertisement banned over misleading claims about impact on environment. It is an example of greenwashing.

• Tesco mobile advertising campaign considered offensive, and banned for using food names as substitute for expletives

2.4.5. Deteriorating UK-EU relations

The UK-EU relations have deteriorated over time. The hostile political environment has directly affected the UK retail industry by rising costs, making business procedures more complex, and causing supply chain disruptions.

However, Guardian reports that after spending six years in hostility, Britain and EU have now started mending their relations, which is a good news for Tesco and other retailers.

2.4.6. Labor shortage and supply chain disruptions

Currently, British retailers are battling with skilled labor shortage and supply chain disruptions. However, Tesco is able to mitigate this threat through a combination of- wide reach and scale of stores, expanded online operations, world-class expertise and strong supplier partnerships.

2.4.7. Aging population

As per Office of National Statistics, UK population is aging fast. As per 2021 census, 18.6% people are above 65 years old in UK, compared to 16.4% noted in previous 2011 census. Changing demographics could be a challenge for retailers as they may have to revisit their marketing mix practices.

3. Summary- SWOT Analysis for Tesco

SWOT analysis Tesco

| Tesco Strengths • Strong market share • E-commerce growth • Low production cost • Supply chain resilience • Wide market reach • Diverse portfolio • Technological infrastructure | Tesco Weaknesses • Poor financial performance • Food quality issues • Poor labor practices • Poor international expansion strategy • Ineffective marketing practices • Leadership change |

| Tesco Opportunities • Emerging economies • Online shopping • Digital transformation • AR/VR and robotics • Strategic partnerships • Growing sustainability trends • Growing vegan/vegetarian market | Tesco Threats • Economic uncertainty • Intense competition • Lawsuits and controversies • Deteriorating UK-EU relations • Supply chain disruptions • Aging population |

SWOT Tesco

Based on SWOT analysis of Tesco, the article proposes following recommendations:

4. Recommendations

• Raise food quality by introducing strict quality control standards

• Adopt transparent marketing and advertising strategy and make honest claims

• Address workers’ concerns and take care of their rights to build positive employer image

• Conduct market research to successfully achieve international expansion objectives

• Fuel growth through strategic alliances, partnerships and acquisitions

• Enter in emerging economies (like Middle East and Africa) to exploit their growth potential

• Invest on robotics to reduce costs and avoid labor shortage issue

• Penetrate deeper in vegan/vegetarian market

• Reduce dependence on EU by finding local suppliers

5. Conclusion

Tesco must proactively respond to changing external environment by leveraging its core strengths, and overcoming its weaknesses. The key strategic causes of concern that seek immediate attention include- poor food quality, negative PR, economic uncertainty, and lawsuits and controversies that affect Tesco brand image.

To know more about Tesco, read our article on Tesco PESTLE analysis and Tesco CSR strategy.

6. References

UK Supermarket Market Share 2023 – Assosia. (2023, April 3). UK Supermarket Market Share 2023 – Assosia. Assosia.

Great Britain: Grocery market share 2023 | Statista. (2023, April 26). Statista.

StackPath. (n.d.).

Tesco Case Study Analysis. (n.d.).

Davey, J. (2021, October 6). Tesco defies supply chain challenges to lift profit outlook. Reuters.

Leading 10 retailers in the UK 2022 | Statista. (2022, September 12). Statista.

Davey, J. (2022, January 5). Britain’s Tesco outperforms rivals over Christmas. Reuters.

Linsell, K. (2022, June 17). Tesco UK Sales Drop as Cost of Living Weighs on Shoppers. Bloomberg.com.

Denton, J., & Thisismoney, B. J. D. F. (2023, April 13). Tesco sees sales rise to £56.7bn but profits halve. This Is Money.

Dabo, M. (2023, April 14). Tesco to face profit stagnation in 2023 as inflation persists. Retail Insight Network.

Kollewe, J., & Partridge, J. (2023, January 31). Tesco to make big changes to stores, affecting 2,100 jobs. The Guardian.

Smart Retail Market Scope, Demand & Analysis by 2029. (n.d.). Data Bridge Market Research, https://www.databridgemarketresearch.com, All Right Reserved 2023.

UK e-commerce revenue 2021 | Statista. (2022, August 4). Statista.

Statista. (2023, March 3). Warehouse automation market size in the UK 2020-2025.

Makortoff, K. (2021, June 7). Supermarket groups Tesco and Carrefour to end three-year alliance. The Guardian.

UK meat alternative market. (n.d.). The Vegan Society.

Armstrong, M. (2023, March 22). UK Inflation Rate Rises Again. Statista Infographics.

Armstrong, M. (2023b, March 22). UK Inflation Rate Rises Again. Statista Infographics.

Masud, B. E. S. &. F. (2023, April 13). Tesco sees profits halve to £1bn as costs rise. BBC News.

Linsell, K. (2023, December 1). Tesco sales rise but profit unchanged amid steep competition. Irish Examiner.

Storey, A. (2022). Voices of our ageing population – Office for National Statistics. www.ons.gov.uk.

Von Bismarck, H. (2022, November 21). Whisper it, but the UK and the EU are starting to mend their broken relationship. The Guardian.