Table of Contents

ToggleThis article presents the Tesla SWOT analysis by scanning the Tesla internal and external environment. The article discusses the business strengths and weaknesses, and also analyzes the opportunities and threats that reside in Tesla’s external business environment.

1. Introduction

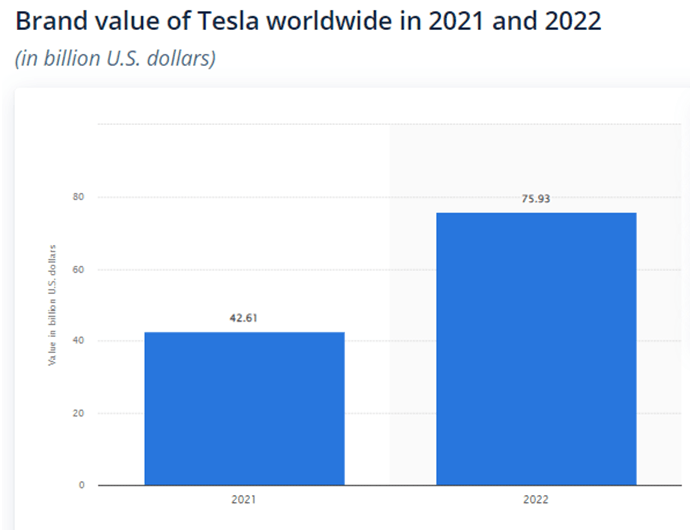

Being world’s most valuable automotive brand, Tesla has successfully grew its brand value by 34% from 2021 to 2022. Tesla is also ranked among the world’s fastest growing companies in 2022.

Tesla SWOT analysis reveals important strategic insights about company’s current and future performance, and covers all factors, including- strengths, weaknesses, opportunities and threats.

2. What is Tesla?

Tesla is a world’s renowned multinational automotive brand, headquartered in USA, Tesla designs massively scalable sustainable systems, and its electric vehicles are some of the world’s safest automotive machines.

| Products/services | Electric vehicles| vehicle accessories| energy storage| solar panels| auto-services| apparel| lifestyle products |

| Tesla competitors | Ford |GM| Volkswagen| NIO |

3. Tesla SWOT Analysis

Tesla SWOT analysis identifies key business strengths and weaknesses based on Tesla internal analysis, and then identifies key opportunities and threats based on Tesla external analysis.

3.1. Tesla Internal Analysis- Strengths and Weaknesses

3.1.1. Tesla business strengths

Key business strengths of Tesla are elaborated below:

1. Brand value

Tesla acquired Facebook to become fifth valuable brand. This acquisition decision raised Tesla brand value from $42.61 billion to $75.93 billion:

Source: Statista

2. Market dominance

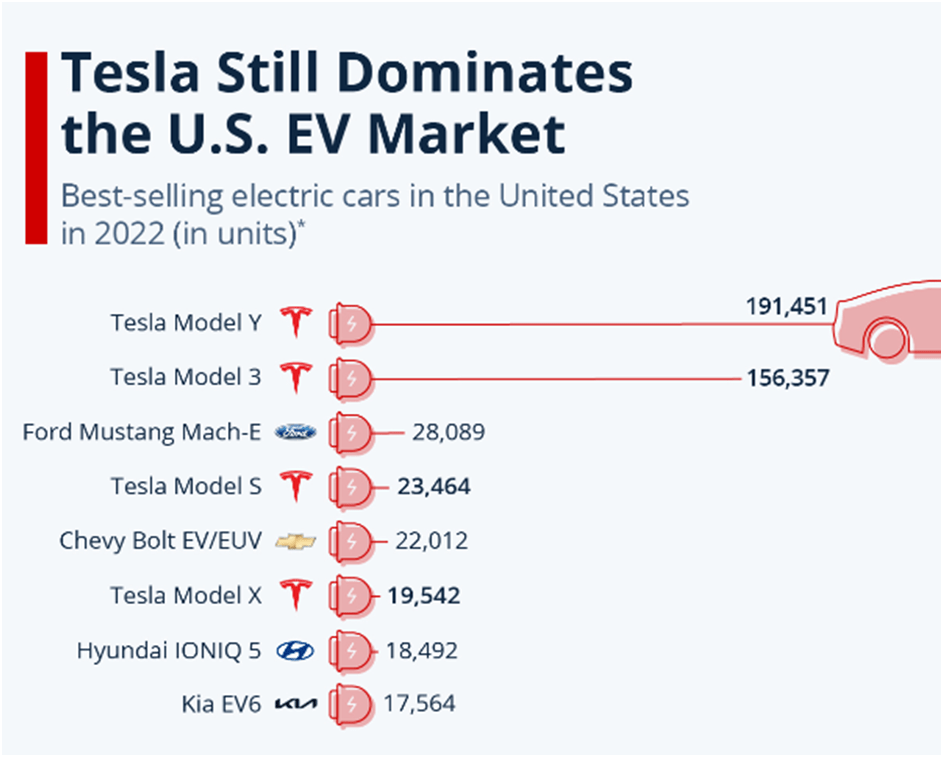

Washington Post reports that Tesla holds strong dominance in U.S market. In 2022, Tesla owned lion share of 65% in U.S electric vehicle market.

3. Competitive positioning

Tesla’s competitors are finding it hard to beat Tesla. Following graph shows Tesla’s model Y and Model 3 hold top two spots in U.S electric vehicle market, followed by Ford’s Mustang:

Source: Statista

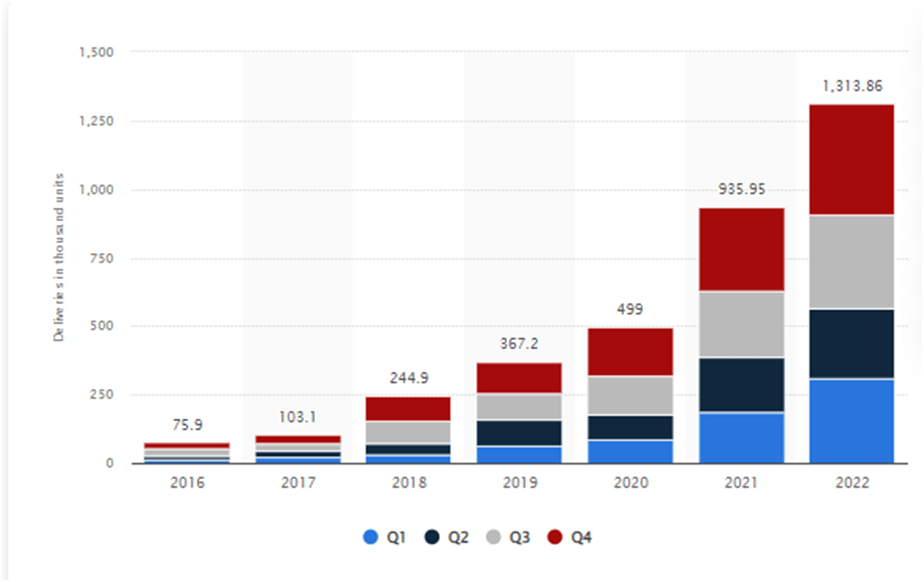

4. Growing sales

Tesla’s sales are continuously growing from 2016 to 2022, as depicted in following graph:

Source: Statista

Above graph reflects the brand’s popularity among Tesla’s target market.

5. Digital transformation

Tesla holds top spot in industrial digital transformation, as reported by Forbes, followed by Intel and BMW.

6. Radical innovation

Tesla competitive advantage lies in successful radical innovation. In 2022, Boston Consultancy Group ranked Tesla as world’s 5th most innovative company. Here are top ten most innovative companies of world:

| Rank | Company |

| 1 | Apple |

| 2 | Microsoft |

| 3 | Amazon |

| 4 | Alphabet |

| 5 | Tesla |

| 6 | Samsung |

| 7 | Moderna |

| 8 | Huawei |

| 9 | Sony |

| 10 | IBM |

Source: Consultancy.UK

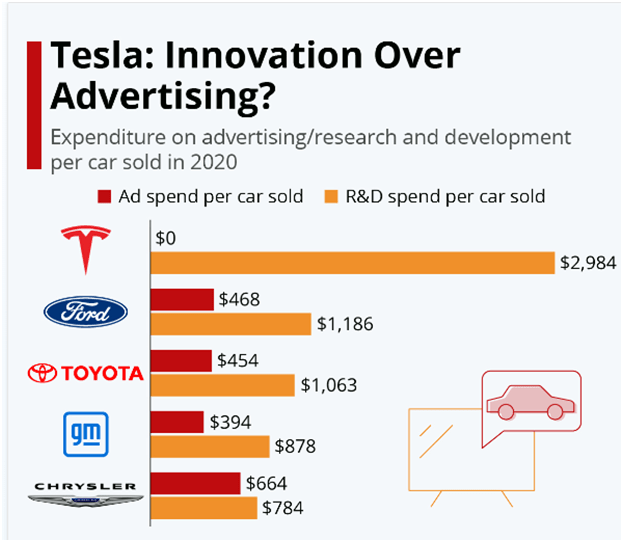

7. Rare research and development capabilities

Interestingly, Tesla invests $0 on advertising, and spends all budget on building rare research and development capabilities. Following graph compares Tesla’s advertising and R&D budget with competitors:

Source: Statista

8. Top employer

A 2021 survey ranked Tesla as second most attractive employer in USA, while Space X held top position.

9. Supply chain resilience

Tesla’s supply chain resilience and vertical integration strategy enabled the company to handle supply chain challenges that have frozen automotive industry.

10. Sustainability

According to Reuters, Tesla scored 9.1 out of 10 on environmental grounds, which is higher than industry average of 6.5, showing strong performance on environmental sustainability grounds.

11. Diversification

Tesla business model is well-diversified. Tesla’s diversification strategy aims to resolve system level limitations and strengthen position in key bottleneck areas.

12. Unconventional marketing strategies

Although, brand has $0 advertising budget (internal linking to ‘advertising part of Tesla marketing article) to communicate with Tesla target market, its unconventional marketing strategies have proven to be a huge success for company. If you want to know more about Tesla’s unconventional marketing strategies, click here (internal linking- Tesla marketing strategy article)

13. Political support

Tesla has good political goodwill, which has historically helped company in securing energy management projects.

14. Effective leadership

Tesla’s CEO- Elon Musk successfully and consistently keeps Tesla under discussion, which is proving to be a highly successful PR strategy.

15. Successful acquisitions

By acquiring some of the best companies, Tesla became fifth most valuable brand. Some recent examples are Tesla’s acquisition of Facebook and Maxwell technologies.

16. Tesla management structure

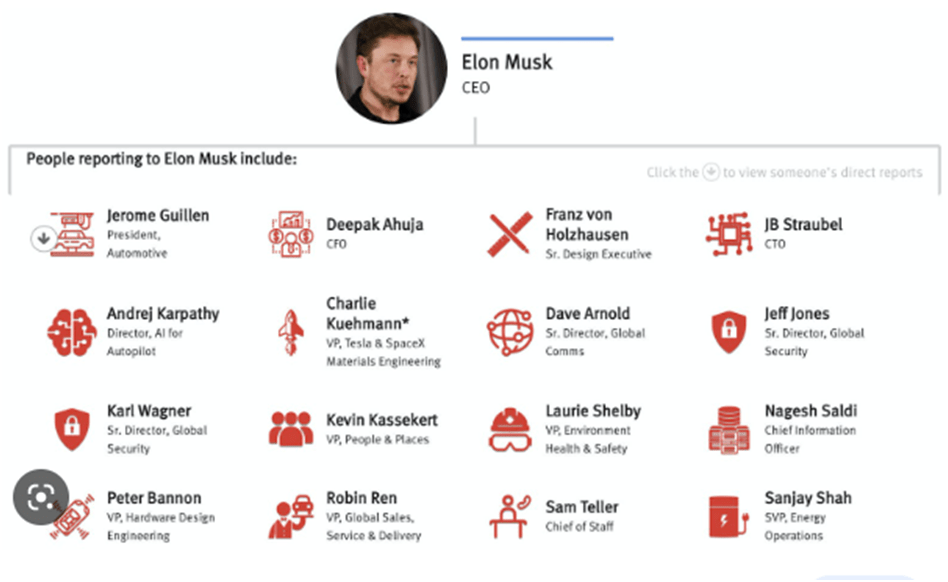

Tesla management structure supports continuous change and innovation, resulting into successful digital transformation. Here is the Tesla organizational chart:

Source: The Information

3.1.2. Tesla weaknesses

1. Limited production capacity

Tesla has limited production capacity. In 2022, Tesla’s giga factory run below capacity. Analysts predicted Tesla deliveries to be 359,162, but Tesla could only deliver 343,830 vehicles due to low production volume- reported Reuters.

2. Material shortage

In 2022, Tesla Shanghai factory lagged in production due to material shortage, and as per CNBC, Tesla will continue facing material shortage issue.

3. Poor work conditions

Due to poor work conditions and racial discrimination cases, Tesla gets a low ESG score of 28.5, which hurts its brand image and depicts company’s poor social performance.

4. Poor liquidity

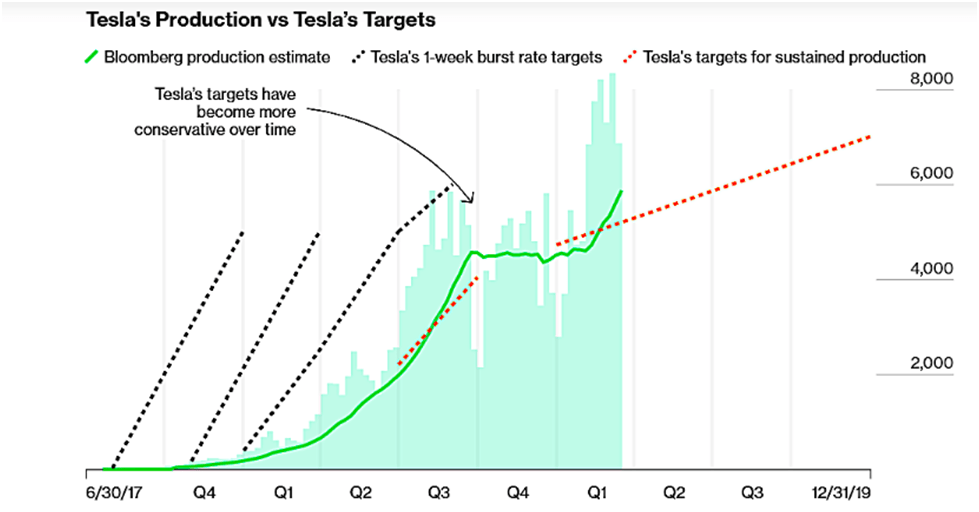

Tesla faces cash problems due to poor liquidity, which according to Bloomberg, directly affect the Tesla’s production volume:

Source: Bloomberg- as reported in CleanTechnica

The above graph shows Tesla’s production targets have become conservative with time due to liquidity issues.

5. High prices

Although, Tesla offers some low priced models as well, but overall, its prices are considered too high. Tesla’s suppliers are under immense pressure, and are asking Tesla to further increase prices by 30%.

6. Declining stock value

In 2022, Tesla shares fell 73% from November 2021, and stock value is down by 69%, which is double than the decline in NASDAQ.

7. Delayed deliveries and poor customer service

Tesla customers are complaining about the long waiting time, delayed deliveries and, some are frustrated with the poor customer service- as reported by Business Insider.

8. Safety issues

The Verge’s reporter Hawkins raised serious concerns over Tesla’s autopilot feature. In 2022, Tesla’s 16 autopilot crashes prompted federal investigation.

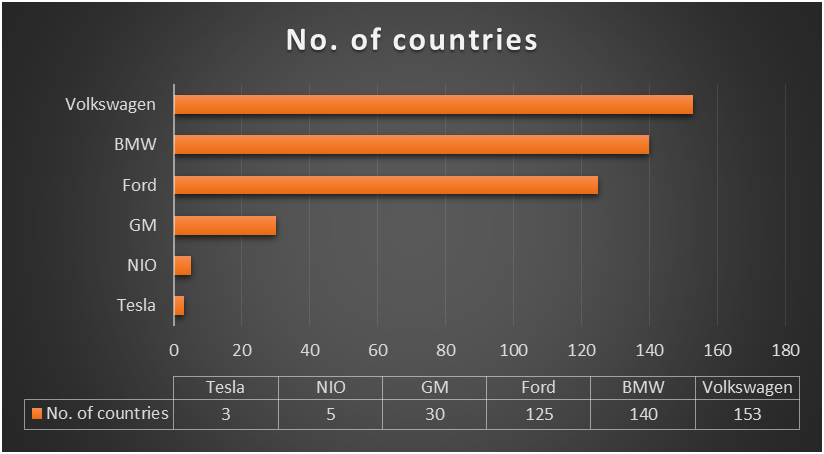

9. Limited geographic reach

Tesla has limited geographic reach compared to its competitors, which weakens its competitive positioning at global stage:

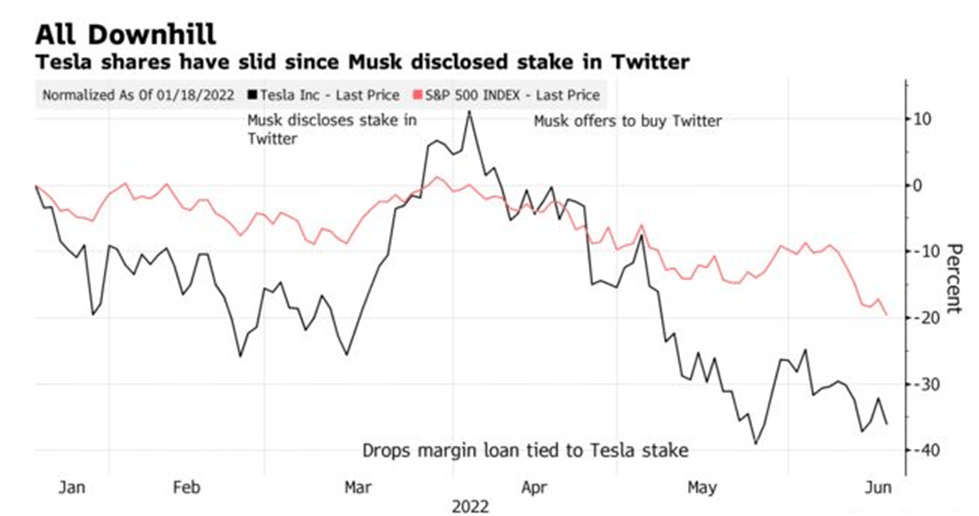

10. Twitter controversy

Tesla’s Twitter takeover was not perceived well by investors, as they considered Elon Musk to be too distracted. It resulted into a clear decline in Tesla’s stock value:

Source: Bloomberg

3.2. Tesla External Analysis – Opportunities and Threats

3.2.1. Tesla opportunities

1. Expansion in Asian region

Electric vehicle market in Asia will have 14.85% growth rate from 2023 to 2027, and it presents exciting growth opportunity to Tesla.

2. More economic models

Tesla can launch more economic models to expand reach to price sensitive customers.

3. Rising sustainability trends

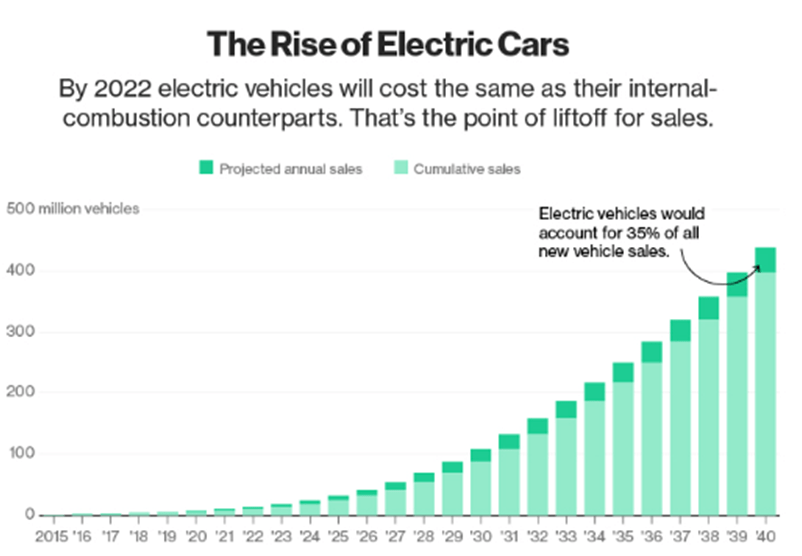

Bloomberg reports continuous rise in demand for electric cars due to consumers’ sustainability concerns:

Source: Bloomberg

4. Economies of scale

Currently, Tesla has limited production facilities. Investment on Giga-Factories can enable Tesla to benefit from the economies of scale in future.

5. Government incentives

Governments around the world are incentivizing the purchase of electric vehicles by lowering taxes, offering free parking and purchase subsidies. It can benefit and help Tesla in expanding its operations in other countries.

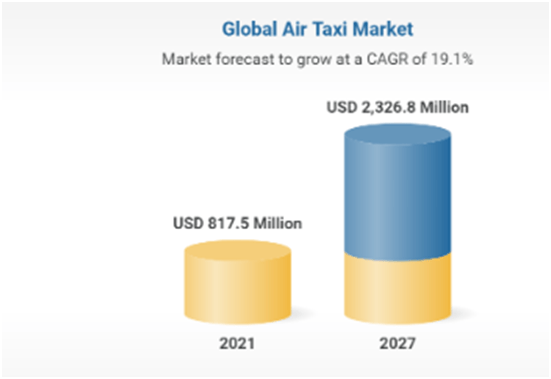

6. Air-taxi market growth

Global Air-Taxi market will grow from $817.5 million (in 2021) to $2326.8 million (2027).

Source: Global Newswire

Tesla has already invested in Air-Taxi start-up, and has capabilities to scale-up operations in air-taxi market.

7. Rental car growth

Global rental car industry will grow with 6.7% CAGR from 2021 to 2027. It has direct implications for Tesla, as Hertz- a car rental firm recently bought 100,000 vehicles from Tesla.

8. In-house battery production

Tesla’s decision to start in-house production of battery cells can reduce the production cost and help Tesla scale up the production.

9. Rising demand for autonomous driving

From 2023 to 2013, autonomous driving market will have 12.1% CAGR rate. Tesla can grab this opportunity by introducing more autonomous driving vehicles.

10. Rising oil prices

Oil prices may increase from $67/b in 2021 to $84/b in 2040. It presents growth opportunity to electric vehicle market.

3.2.2. Tesla Threats

1. Material shortage

Material shortage and high price volatility of Lithium-ion, cobalt, copper, steel and aluminum can affect the Tesla’s production.

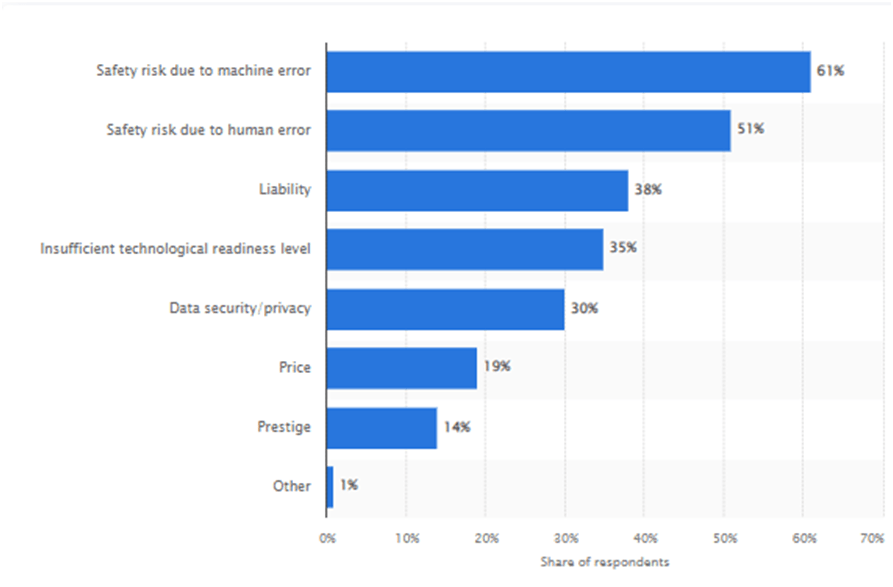

2. Consumers’ unaddressed concerns towards self-driving vehicles

A 2021 survey showed consumers are still concerned towards using self-driving vehicles:

Source: Statista

It can be a cause of concern for Tesla, which plans to launch more fully autonomous vehicles.

3. Rising competition

Intensifying competition and slipping demand is threatening the Tesla’s competitive positioning. As per Financial Times, inability to handle competition can create serious troubles for Tesla.

4. Global downturn

Global downturn is affecting the demand for expensive electric vehicles. It has also compelled the Tesla to cut prices by up to fifth to increase the demand- as reported by BBC.

5. Regulatory issues

Regulatory issues will likely prevail in the self-driving vehicle market in future. Such regulatory uncertainty can affect Tesla’s performance in autonomous vehicle market.

6. Reputation damage

Elon Musk’s marijuana controversy has affected the brand reputation, and hit Tesla stock by $420 per share.

4. Summary- Tesla SWOT Analysis

Tesla SWOT analysis 2023

| Strengths • Brand value & market dominance • Competitive positioning • Growing sales • Digital transformation • Radical innovation & R&D capabilities • Top employer • Supply chain resilience • Sustainability • Diversification • Unconventional marketing strategies • Political support • Effective leadership & efficient management structure • Successful acquisitions | Weaknesses • Limited production capacity • Material shortage • Poor work conditions • Poor liquidity • High prices • Declining stock value • Delayed deliveries and poor service • Safety issues • Limited geographic reach • Twitter controversy |

| Opportunities • Expansion in Asia • More economic models • Rising sustainability trends • Economies of scale • Government incentives • Air-taxi market growth • Rental car growth • In-house battery production • Rising demand for autonomous driving • Rising oil prices | Threats • Material shortage • Concerns towards self-driving vehicles • Rising competition • Global downturn • Regulatory issues • Reputation damage |

SWOT analysis tesla

5. Recommendations

• Expand presence in Asian region

• Introduce more economic models

• Bring battery production in-house to resolve material shortage issues

• Open more production facilities to avail benefits of economies of scale

• Expand presence in air-taxi market

• Resolve poor work conditions issues to improve social performance

• Avoid unrelated diversification (like Twitter) in future that may hamper investors’ trust

• Resolve technical issues (autopilot) to regain customers’ trust

• Improve liquidity position to scale up the production

6. Concluding remarks

Tesla SWOT analysis suggests that despite all weaknesses and threats, Tesla is capable of achieving its ambitious growth objectives. However, Tesla needs to pro-actively respond to the external environment to preserve leadership position in electric vehicle market.

7. References

Tesla brand value 2022 | Statista. (2023, January 6). Statista.

Tesla brand value 2022 | Statista. (2023b, January 6). Statista.

Whalen, J. (2023, January 13). Battle to dethrone Tesla heats up just as Musk is distracted by Twitter. Washington Post.

Richter, F. (2023, January 3). Tesla Still Dominates the U.S. EV Market. Statista Infographics.

Tesla: vehicle sales by quarter 2022 | Statista. (2023, January 4). Statista.

Banker, S. (2022, February 7). Tesla Achieves The Top Ranking In The Industrial Digital Transformation Top 25 Report. Forbes.

Consultancy.uk. (2022, September 23). The world’s most innovative companies (according to BCG).

Armstrong, M. (2022, March 21). Tesla: Innovation Over Advertising? Statista Infographics.

U. (2022, September 8). How To Supercharge Your Employer Brand Like Elon Musk – Universum. Universum.

Jessop, S. (2022, May 20). Analysis: Musk’s ESG attack spotlights $35 trillion industry confusion. Reuters.

Efrati, A. (2021, July 2). Tesla Turnover Revamps Executive Team. The Information.

Jin, H. (2022, October 2). Tesla’s logistical challenges overshadow record deliveries. Reuters.

Kolodny, L. (2022, May 10). Tesla production lags in Shanghai due to parts shortages, Covid restrictions. CNBC.

Baxter, M. (n.d.). Tesla’s low ESG score can partly be explained by figure skating. GRC World Forums.

Grinshpun, M. (2019, March 24). No, Wall Street — Tesla Has No Cash Or Liquidity Problem (And A P.S. For Elon Musk). CleanTechnica.

Tesla’s suppliers facing cost increases “of up to 30%.” (2022, April 22). Supply Chain Magazine.

Matousek, M. (2018, August 23). Some new Tesla cars are being delivered with flaws, and owners say getting them fixed is a painful process. Business Insider.

Hawkins, A. J. (2022, June 9). The federal government’s Tesla Autopilot investigation is moving into a new phase. The Verge.

Dey, E. (2022, June 16). Tesla Stock Has More Than Twitter Weighing on It. Bloomberg.com.

Statista. (n.d.-a). Electric Vehicles – Asia | Statista Market Forecast.

Here’s How Electric Cars Will Cause the Next Oil Crisis. (n.d.). Bloomberg.com.

Markets, R. A. (2022, September 9). Global Air Taxi Market Report 2022: Demand for Better and Efficient Transportation Systems Driving Growth. GlobeNewswire News Room.

Yahoo is part of the Yahoo family of brands. (n.d.-c).

Amadeo, K. (2022, December 2). Oil Price Forecast 2023-2050. The Balance.

Statista. (2022c, September 28). Main concerns among customers regarding autonomous cars globally 2021.

Waters, R., Bushey, C., & Campbell, P. (2023, January 6). Trouble at Tesla: the end of a golden age of growth? Financial Times.

Hooker, B. L. (2023, January 13). Tesla cuts prices by up to a fifth to boost demand. BBC News.

Jaeger, K. (2019, December 23). Elon Musk Makes Marijuana Joke After Tesla’s Stock Hits $420 – Marijuana Moment. Marijuana Moment.