Table of Contents

Toggle1. Introduction

Sephora retains the top spot for offering the personalized experience in fashion industry. This article presents Sephora SWOT analysis. The article presents a detailed strategic analysis of Sephora’s internal and external business environment, and analyzes how Sephora has gained so much success.

2. Company Overview

Sephora is a French company- established in 1970 by Dominique Mandonnaud, and owned by LVMH Moët Hennessy Louis Vuitton. Here is basic company overview:

| Founding year | 1970 |

| Headquarters | Paris |

| Industry | Lifestyle, fashion industry |

| Sephora competition | Urban Decay, Ulta Beauty, MAC, Macy’s, Nordstrom |

| Sephora market capitalization (2022) | $404.85 billion (LVMH) |

| Sephora revenue (2022) | €79.2bn |

| Sephora products | Skincare, makeup, hair and beauty, fragrances |

The article presents the Sephora case study solution by highlighting the most important strategic factors that determine company’s competitive positioning in the market. The article also presents the SWOT analysis of beauty industry by discussing implications of each strategic factor for both- overall industry, and company.

3. Sephora SWOT Analysis

3.1. Sephora Strengths

3.1.1. Market share

In USA, Sephora retains strong competitive positioning in the cosmetics industry. The company holds 11.3% market share (based on overall industry revenue) – as reported by IBIS.

3.1.2. Digital experience

Sephora is considered the e-commerce trendsetter. Currently, its digital business is experiencing major transformations according to customers’ changing interests. Sephora offers unified shopping experience across multiple channels, is adding more personalized content, and is scaling up for the busy periods.

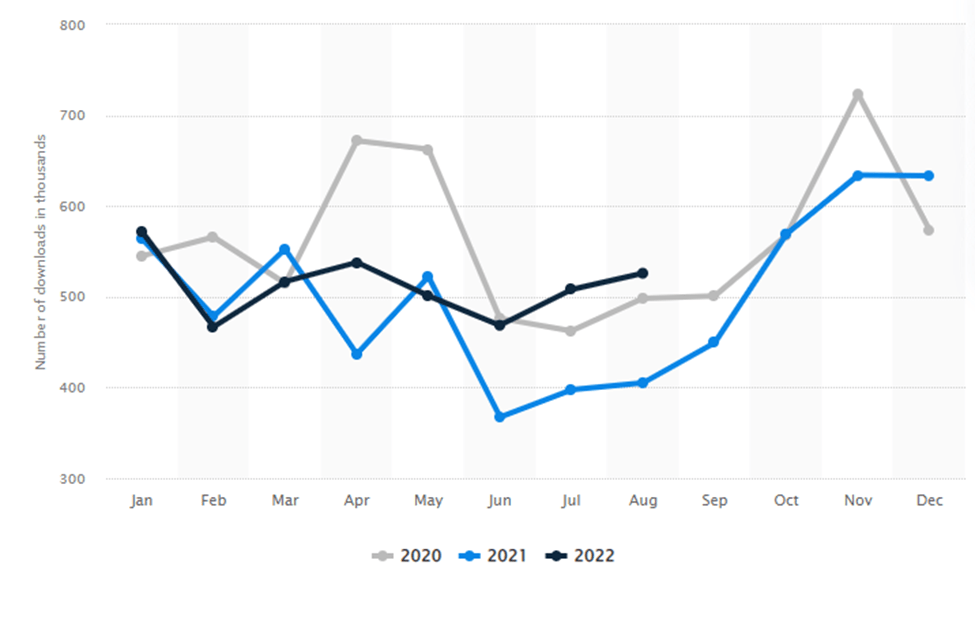

Here is the graph showing the monthly downloads of Sephora app from 2020 to 2022:

Source: Statista

3.1.3. Growth engine

Sephora is the engine for LVMH growth. Since 2008, JC Penney mentioned Sephora 234 times on earnings calls:

Source: CB Insights

3.1.4. Wide variety

Is Sephora expensive? Well, Sephora is a high-end brand, but it also offers mid-range, and affordable prices. With large product variety and 300 sub-brands, Sephora products includes both- mass collection and high-end, unique products.

3.1.5. Strong brand image

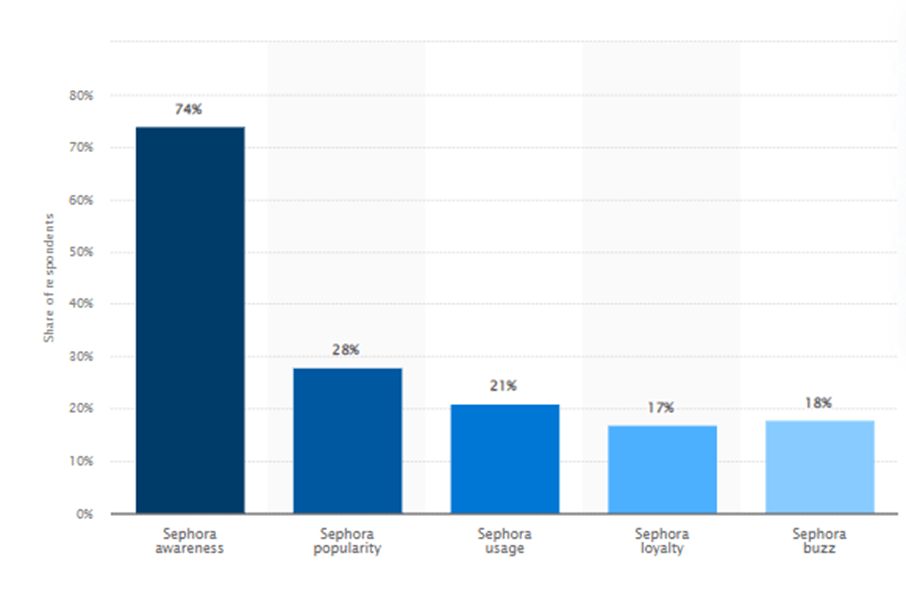

Statista recently reported that around 74% customers in USA know Sephora. Among 74%, around 38% customers like Sephora, and 21% customers frequently use Sephora. Out of 21% customers who use the brand, 81% show brand loyalty. Moreover, 24% of the customers say that there is buzzword about Sephora in USA.

Following graph summarizes the key survey findings, showing Sephora’s strong brand image:

Source: Statista

3.1.6. Strong social media presence

Sephora has strong online presence. It operates online as Sephora Direct to sell the leading brands onsite. Sephora direct case study shows the company is doubling its budget for social media, mobile and video marketing to expand the reach to the target market.

3.1.7. Revenue growth

Sephora is experiencing exponential revenue growth. In 2022, LVMH recorded record breaking sales due to Sephora’s incredible performance. The brand reported 23 percent rise in the revenue in 2022 compared to 2021.

3.1.8. Innovation performance

In 2021, Sephora’s innovation score raised from 79 to 89 points out of 100 due to its focus on the Omni channel personalization, personalized shopping experience and user engagement.

3.2. Sephora Weaknesses

3.2.1. Limited geographic reach

Sephora has limited reach to the Asian market, and is not performing well in this region. For instance, Sephora Korea recorded loss for two consecutive years (2020-2021). Brand is also struggling to expand in China and Hong Kong.

3.2.2. Supply chain and logistics issues

Vogue reports that Sephora is currently dealing with the logistics hurdles due to squeezed supply chain. Skilled labor shortage is also causing troubles for Sephora.

3.2.3. Too expensive

A survey on 42 brands of Sephora shows customers no longer like expensive, high end beauty brands more than the cheap brands. Research further suggests that many customers consider Sephora to be bit too expensive.

3.2.4. Poor customer service

Sephora remains under fire by its customers due to undelivered orders, clue less in-house workers, poor customer service.

3.2.5. Recent controversies

Sephora controversy 2021 hurt brand when conservative fashion customers started boycotting Sephora after it cut ties with the pro-Trump influencer.

3.2.6. Dilution

Sephora’s parent company sells many beauty and cosmetic brands, which are direct competitors to Sephora and affect its sales. It harms the parent company brand image, and creates confusion among customers.

3.3. Sephora Opportunities

3.3.1. Industry growth

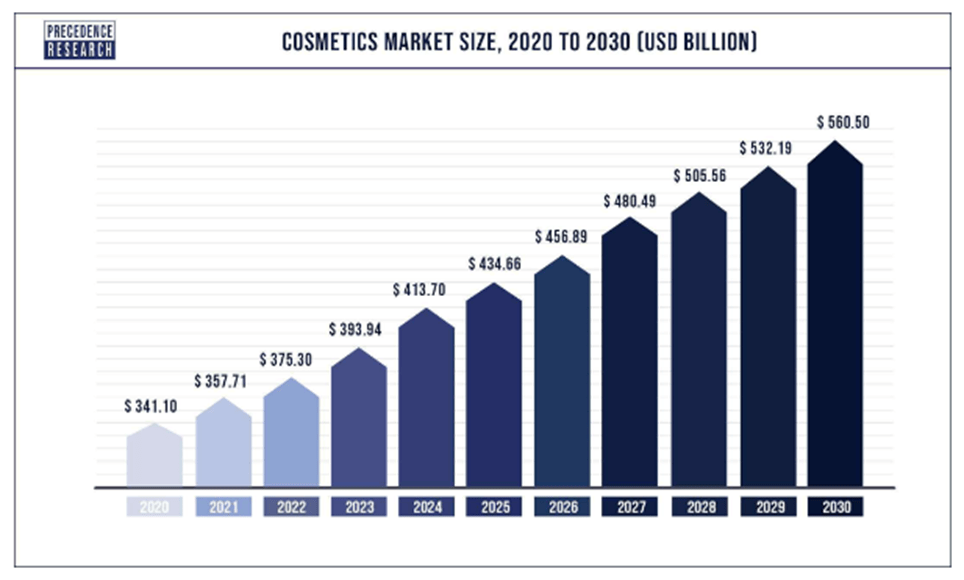

Global cosmetic industry is expected to grow to $560.50 billion by 2030. The industry is experiencing consistent growth from 2020 to 2030:

Source: Precedence Research

The above statistics indicate the wide growth potential in cosmetics industry. Sephora may consider it an opportunity to expand operations to the world’s most lucrative markets.

3.3.2. Geographic expansion

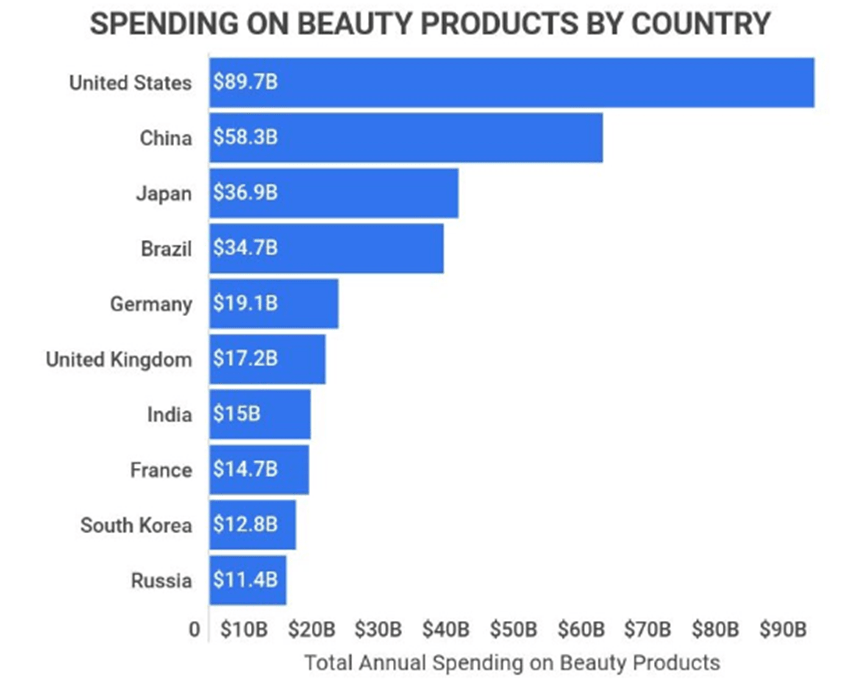

There is a consistent rise in the demand for beauty products in Asian region. Following graph shows China and Japan are most lucrative markets for cosmetic brands after USA:

Source: Zippia.com

Sephora may consider penetrating deeper into Asian region to strengthen the presence at international stage.

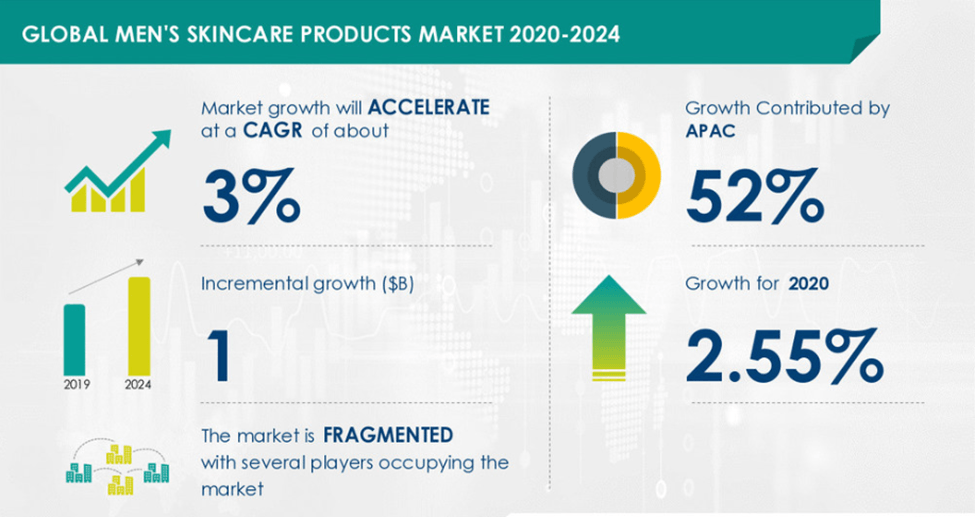

3.3.3. Penetration in men’s segment

According to PR Newswire, global men cosmetics industry is expected to grow by $1 billion from 2020 to 2024. Following image presents a glimpse of men beauty industry growth forecast:

Source: PR Newswire

Sephora may penetrate deeper into the men cosmetics market to avail the exciting growth opportunities.

3.3.4. Social media influencers

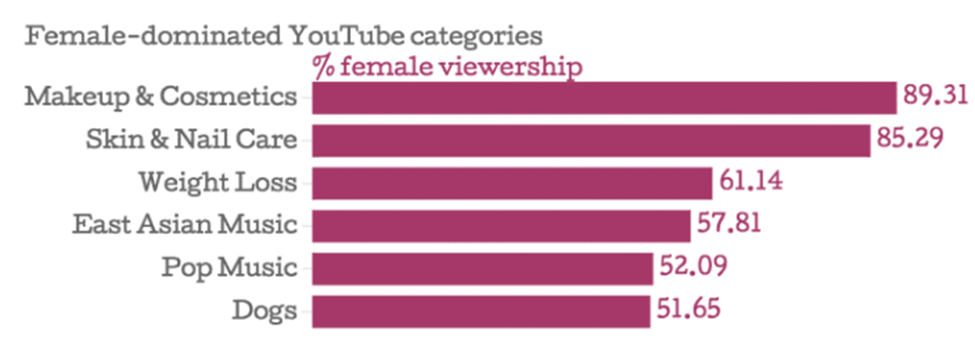

There is growing trend of influencer marketing in beauty and cosmetics industry. Influencer marketing is most popular among female beauty and cosmetics customers.

Following graph shows the make-up and cosmetics is the most popular YouTube category among females, indicating the potential of influencer marketing for beauty brands:

Source: Content Works

Considering the success of Sephora-Squad, Sephora may increase investment on the influencer marketing to capture the attention of millennials.

3.3.5. Acquisitions and partnerships

Forbes suggests Sephora to pursue its growth objectives through acquisitions and partnerships. Recently, Sephora re-entered in UK after 17 years through a successful acquisition of worth $147 million.

3.3.6. Mid-range products

Considering the looming recession and customers’ reducing purchasing power, Sephora can increase the range of affordable luxury products.

3.3.7. Organic, sustainable cosmetic products

As per Statista, the global market value of organic cosmetic products will likely grow from $9 billion (2021) to $20.4 billion. Sephora may increase variety of green, all organic luxury fashion products to respond to the customers’ changing preferences.

3.4. Sephora Threats

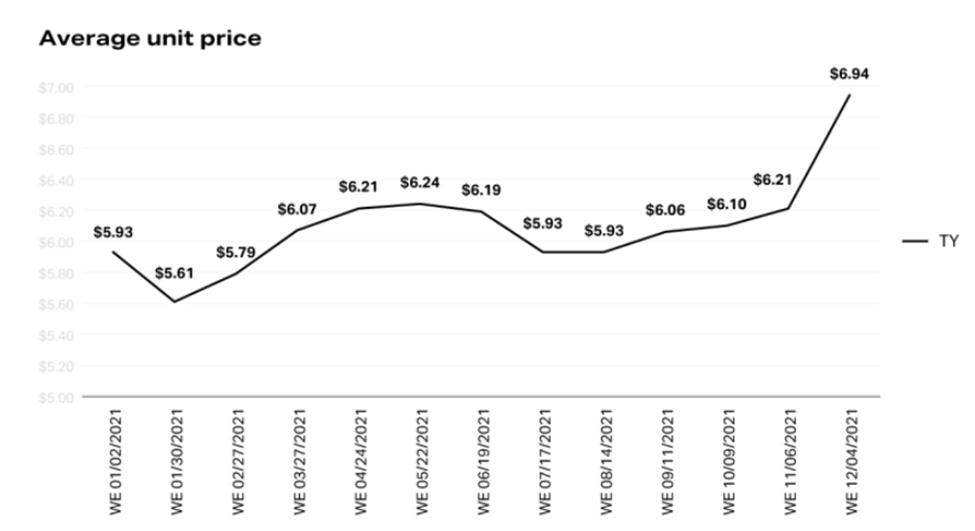

3.4.1. Rising inflation

Rising inflation has emerged as a major threat to beauty brands. As per Nielson IQ, the rising inflation is compelling beauty brands to raise their prices in response to rising costs:

Source: Neilson IQ

The graph shows a consistent rise in average price of beauty products in response to inflation. It can hurt Sephora’s financial performance by reducing sales and raising production cost.

3.4.2. Growing competition

The competition in the U.S cosmetic industry is getting intense, and marketing is getting overly saturated, compelling brands like Sephora to explore growth opportunities outside USA.

3.4.3. Privacy concerns

Customer privacy is hindering the innovation in beauty and cosmetics industry. Cosmetics customers are increasingly getting concerned about their privacy. Recently, Sephora faced fine of $1.2 million for violating the privacy laws.

3.4.4. Counterfeit threat

A recent survey indicated that 1 in 3 customers in USA unintentionally bought counterfeit fashion product. This threat is growing, and is directly affecting the sales of original fashion brands like Sephora.

4. Sephora SWOT Analysis- Summary

| Strengths: Strong market share Digital experience Growth engine Wide variety Strong brand image Strong social media presence Revenue growth Innovation performance | Weaknesses: Limited geographic reach Supply chain and logistics Too expensive Poor customer service Recent controversies Dilution |

| Opportunities: Industry growth Geographic expansion Penetration in men’s segment Social media influencers Acquisitions and partnerships Mid-range products Organic cosmetic products | Threats: Rising inflation Growing competition Privacy concerns Counterfeit threat |

Sephora SWOT analysis

5. Recommendations

Based on Sephora SWOT analysis, the article proposes following recommendations:

• Expand in Asian region

• Invest more on organic cosmetic products

• Penetrate into men’s beauty segment

• Find strategic partners to enter in emerging Asian markets

• Increase variety of mid-range products

• Improve customer service by responding to customers’ concerns

• Invest on PR to respond to the recent controversies

• Handle the privacy concerns by protecting the customers’ sensitive information

6. Conclusion

To conclude, Sephora holds strong strategic positioning, and has potential to expand into emerging markets. However, Sephora needs to address its weaknesses, and respond to the looming threats to avail the available opportunities.

7. References

IBISWorld – Industry Market Research, Reports, and Statistics. (n.d.).

Statista. (2023, January 27). Sephora monthly app downloads worldwide 2020-2022.

CB Insights. (2021, July 12). How Sephora Built A Beauty Empire To Survive The Retail Apocalypse. CB Insights Research.

Statista. (2022, December 14). Sephora brand profile in the United States 2022.

LVMH’s record-breaking results driven by Sephora. (n.d.).

Berthiaume, D. (2021, March 3). Sephora keeps top spot for personal experience. Chain Store Age.

Caldwell, G. (2022, May 3). Will Sephora pull out of Korea? Global Cosmetics News.

Mattone, J. (2019, March 29). Review data reveals that customers don’t like expensive beauty products any more than cheap ones.

Cosmetics Market Size to Hit Around US$ 560.50 Billion by 2030. (n.d.).

24 Powerful Cosmetics Industry Statistics [2023]: What’s Trending In The Beauty Business? – Zippia. (2023, January 16).

T. (2021, June 6). Global Men’s Skincare Products Market to grow by $ 1 Billion during 2020-2024 | Growing popularity of anti-pollution skincare products to drive growth | Technavio.

C. (2017, November 9). How the Beauty Industry Uses Influencers. Contentworks.

Faithfull, M. (2022, October 11). Sephora Returns To U.K. Next Week, 17 Years After Shutting Up Shop. Forbes.

Statista. (2022a, December 14). Global market value of natural and organic skin care 2021-2030.

NielsenIQ. (2022, March 25). Inflation unboxed: How inflation impacts beauty categories.

Chavez, T. (2022, October 27). Sephora’s $1.2 Million Fine Proves Customer Privacy Is An Innovation Imperative. Forbes.

Counterfeit beauty and consumer trends | Smart Protection. (n.d.).