Table of Contents

ToggleBeyond Meat is among the fastest growing food companies in USA. The company is successful in sustaining the first mover advantage. According to Time Magazine, Beyond Meat topped the list of most innovative food companies in USA in 2022, and was listed among world’s top 100 most influential companies.

Let’s explore Beyond Meat’s current strategic positioning in light of SWOT framework.

1. Company overview

| Company name and type | Beyond Meat (public) |

| Year founded | 2009 |

| Headquarters | El Segundo, California, USA |

| CEO | Ethan Brown |

| Industry | Food processing |

| Number of countries | 50 |

| Number of employees 2021 | 1419 |

| Revenue 2022 | $425 million |

| Market capitalization (December 2022) | $9 billion |

Source: Macro-Trends| Statista| Beyond Meat

| Beyond Meat products | Plant based meat products, ranging from- beyond burger, beef, sausage, chicken, meat balls. New 2022 addition- beyond steak |

| Beyond Meat target market | Wide target- Meat avoiders, meat reducers, meat consumers, vegans, vegetarians and semi-vegetarians. Core target- Meat reducers looking for better protein options |

| Beyond Meat competitors | Impossible foods, East Just, Ripple foods, Alpha foods |

2. Beyond Meat SWOT Analysis

SWOT analysis of Beyond Meat requires scanning of company’s internal and external business environment.

3. Internal Analysis

3.1. Beyond Meat Strengths

3.1.1. Strong R&D

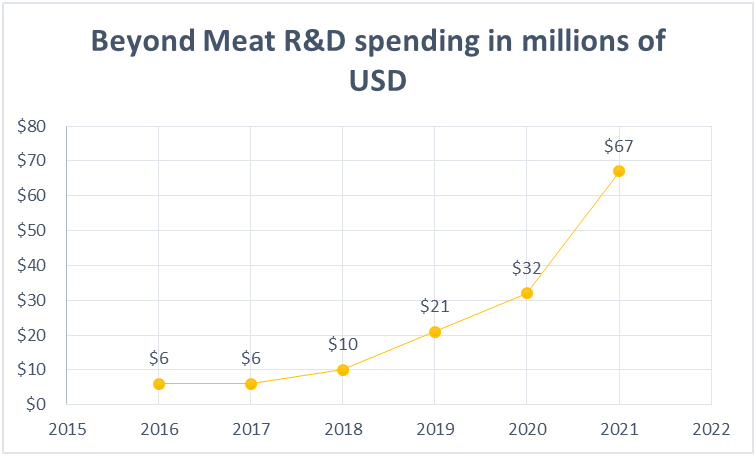

Beyond Meat spends heavily on research and development to remain innovative. Following graph shows Beyond Meat’s research and development spending:

Source: self-drawn by extracting data from Macro-Trends

Due to strong R&D capabilities, Beyond Meat’s steak was listed in Times’ best inventions list 2022.

3.1.2. Product quality

Unlike its competitors who use Soy as proteins, Beyond Meat uses beans and peas that are GMO free, and enhance product nutrition value. Its new product addition in 2022- Beyond Steak has gained enormous positive response from customers.

3.1.3. Beyond Meat marketing strategy

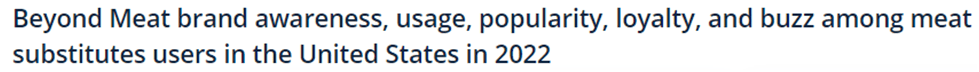

By focusing on sustainability and health benefits, Beyond Meat marketing strategy has been successful in creating the buzz word on social media. A 2022 survey with U.S meat consumers showed 31% consumers were aware of the buzz word about Beyond Meat, and 70% were aware of the brand.

3.1.4. Loyal customer base

Beyond Meat has highly loyal customer base. A 2022 survey showed approx. 28% of users said they will re-purchase from Beyond Meat. In relation to 39% brand usage, it shows 72% of Beyond Meat customers show brand loyalty.

3.1.5. Corporate partnerships

Beyond Meat has formed partnerships with large restaurants and retailers to expand the market reach. Recently in 2022, Beyond Meat partnered with McDonalds, and Pepsi. These partnerships help Beyond Meat scale up production, bring innovation, reach more customers, and raise brand recognition.

3.1.6. Beyond Meat brand image

Beyond Meat holds strong brand image as an earth-friendly alternative to meat processors. Customers view it as a socially responsible brand that offers green and healthy way of consuming protein.

3.1.7. Strong brand recognition

Beyond Meat has strong brand recognition. A 2022 survey with U.S meat consumers showed around 31% consumers heard about brand in last three weeks, and 70% already knew the brand. Following graph shows high brand awareness of Beyond Meat:

Source: Statista

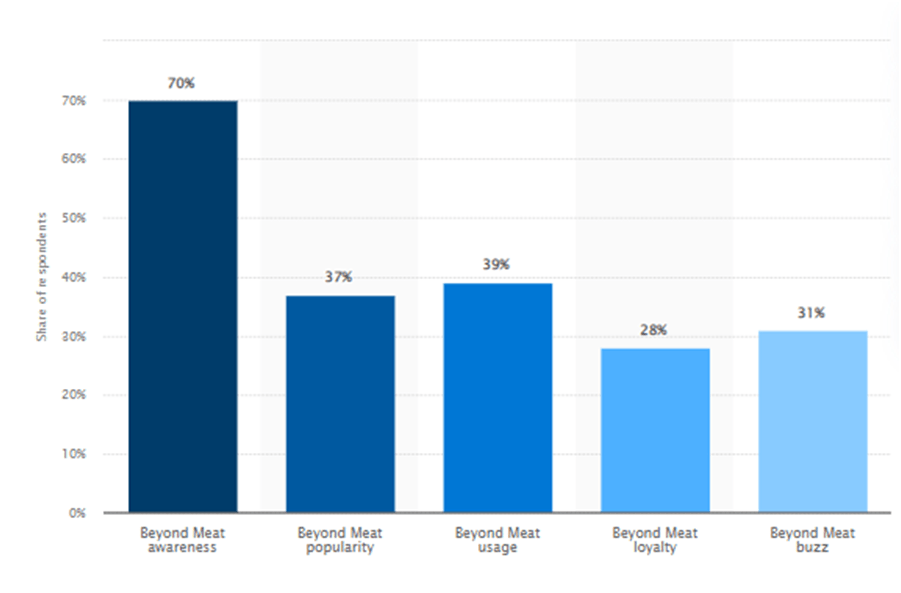

3.1.8. Revenue growth- 2016-2022

Beyond Meat is among U.S’s fastest growing companies. Following graph shows the company’s consistent revenue growth:

Source: Self-drawn by extracting data from macro-trends

3.2. Beyond Meat Weaknesses

3.2.1. Beyond Meat supply chain issues

Beyond Meat supply chain woes need immediate attention. Labor constraints, damaged packaging and supply chain disruptions due to severe weather conditions are affecting the Beyond Meat’s order filling capabilities.

3.2.2. Declining operating margin

Combination of lower prices and rising costs has directly affected the Beyond Meat’s gross margins, as depicted in following graph:

Source: Seeking alpha

Due to stalled growth and high expenses, Beyond Meat plans to lay off 19% of its workforce, which can hurt its brand image.

3.2.3. Lack of variety

Company offers a limited product variety. Company has not added lamb, plant based eggs and other dairy products, which limits its reach to the target market.

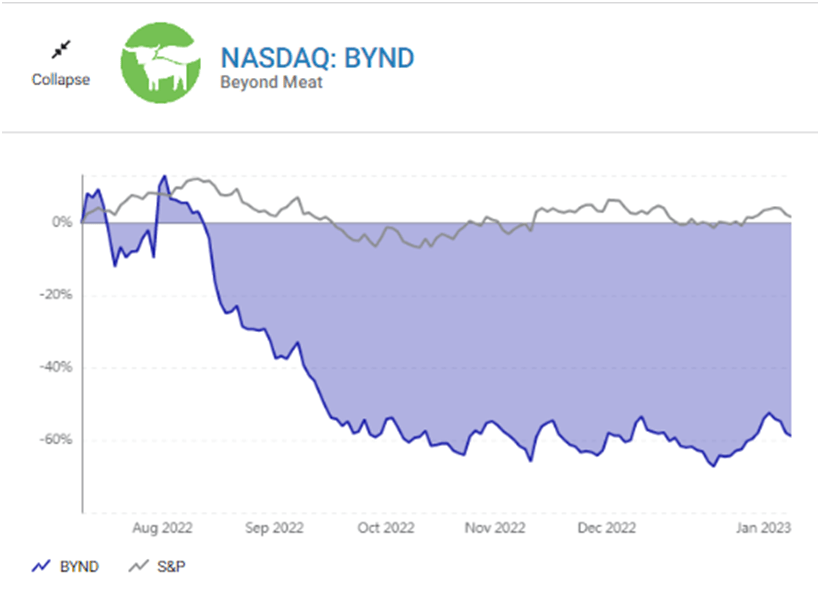

3.2.4. Stalled growth

Although, Beyond Meat revenue has been consistently growing from 2016, but the growth is somehow stalled since 2019. Some key reasons responsible for stalled growth are- hygiene issues, high operating expenses and broader industry problems (discussed in ‘threats’ section).

Despite lowering the prices, Beyond Meat revenue has been declining from third quarter of 2022 with negative growth forecast in the short-term:

Source:The Motley Fool

3.2.5. Food safety issues

Recently, Beyond Meat faced criticism for food safety issues, when Bloomberg posted photos showing evidence of listeria and mold in company’s Pennsylvania plant.

Customers’ concerns towards using coconut oil that carries high amount of saturated fat is also a problem for Beyond Meat that excessively relies on coconut oil to give its products a meat like structure.

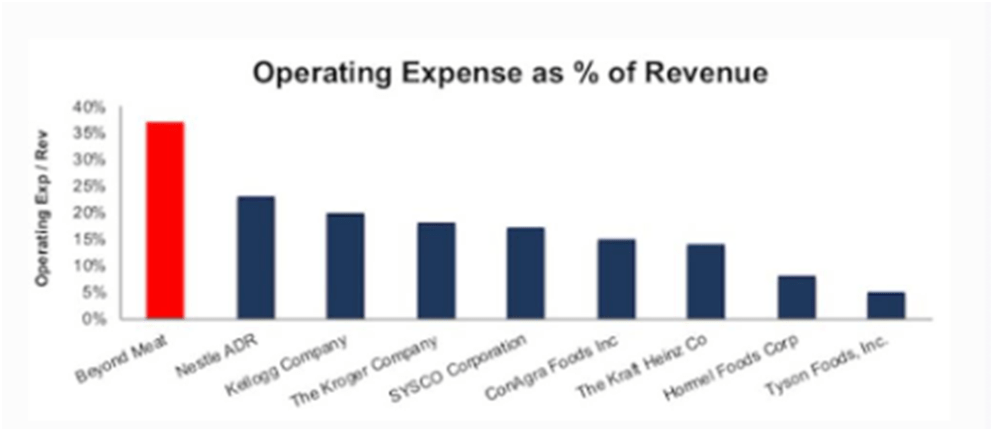

3.2.6. Weak financial health compared to competitors

Compared to competitors, Beyond Meat has high operating expenses and low profitability, which affects its financial health, as depicted in following graphs:

Source: Forbes

Another graph shows comparatively weaker financial health of Beyond Meat than its competitors:

Source: Forbes

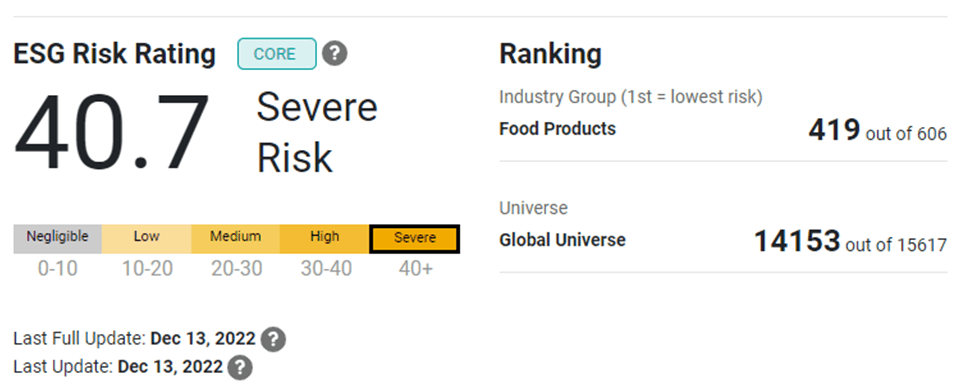

3.2.7. Sustainability issues

As per New York Times, Beyond Meat performs poorly on sustainability grounds, because company does not share sufficient information to prove that it is more sustainable than traditional meat processors. Its ESG (environmental, social and governance) rating is 40.7, which puts it in ‘severe risk’ category.

Source: Sustainalytics

3.2.8. Weak global presence

Currently, Beyond Meat has strong presence in U.S market, but is yet unable to secure a strong position in global food processing market.

4. Beyond Meat External analysis

An overall SWOT analysis of food industry highlights various opportunities and threats that can influence the Beyond Meat competitive positioning. These opportunities and threats are discussed below:

4.1. Beyond Meat Opportunities

4.1.1. Expansion in emerging markets

Kerry’s research showed 62% customers in Asian region are interested in purchasing the plant based meat. Beyond Meat can penetrate deeper into Asian region to fuel the growth.

4.1.2. Expanding vegan market

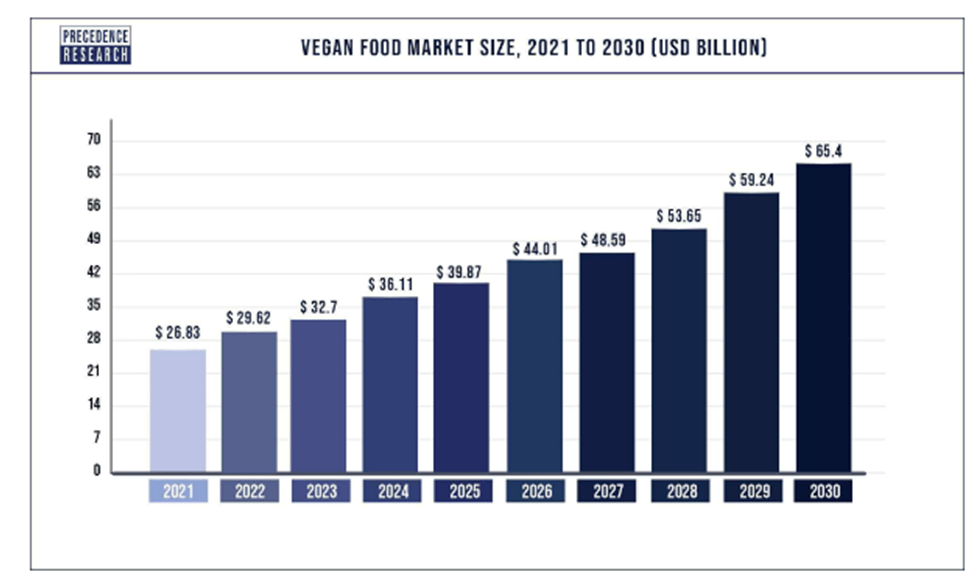

Expanding vegan market (as depicted in graph below) present growth opportunities to plant based meat companies:

Source: Precedence Research

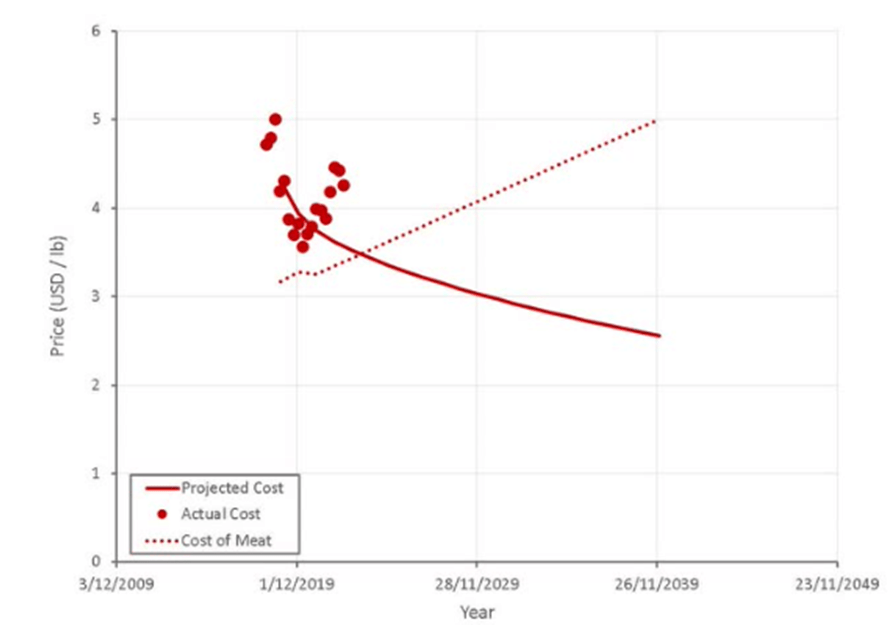

4.1.3. Rising animal meat prices

Growing economic uncertainty are making consumers more price conscious. The animal meat prices are likely to rise in future. Particularly, beef prices will increase 15% in 2023. Beyond Meat can invest on R&D to lower the meat prices and expand reach to price sensitive customer segment.

4.1.4. Marketing efforts focused upon winning customer trust

Beyond Meat can invest on marketing and communication initiatives that address consumers’ health concerns, and adopt a clear health policy to win their trust.

4.1.5. Expand product portfolio

Beyond Meat can add plant based eggs and lamb to increase product variety, and expand reach to more customers.

4.2. Beyond Meat Threats

4.2.1. Hampered trust on plant based meat industry

A recent survey by Deloitte (as reported by Financial Post) with 2,000 customers showed a visible decline in customers’ belief that plant based meat is a healthier option for them. The declining trust on plant based meat has negative implications for Beyond Meat.

4.2.2. Intensifying competition

The competition in plant based meat industry is getting intense with time, and Beyond Meat is facing tough competition from many existing and new players. The industry giants like JBS and Tyson Foods have started betting on the cultivated protein, making business environment increasingly tough for Beyond Meat.

4.2.3. Economic uncertainty

Inflation, raising prices, labor shortage and supply chain constraints are some major economic factors that are dimming the growth expectations of plant based meat industry.

4.2.4. Slow industry growth

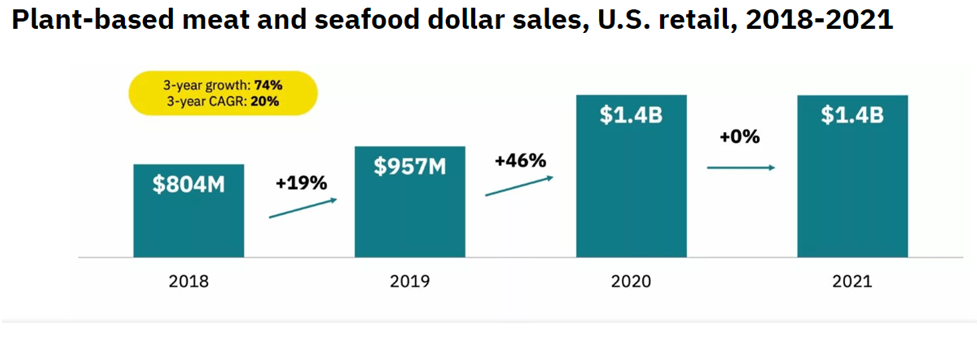

Plant based meat industry growth has stalled, as depicted in following graph:

Source: Good Food Institute

The stalled industry growth can be a result of various factors including supply chain disruptions, inflation and pandemic.

4.2.5. Existential threat to Beyond Meat

Beyond Meat is facing existential threat as it is unable to convince customers that plant based meat is healthier. An evidence to support this statement is that despite 10% price reduction, company is unable to generate more sales.

5. Summary

Beyond Meat SWOT analysis

| Strengths Strong R&D Product quality Efficient marketing strategy Loyal customer base Corporate partnerships Strong brand image and recognition Revenue growth | Weaknesses Supply chain and sustainability issues Declining operating margin Lack of variety Stalled growth Food safety issues Weak financial health Weak global presence |

| Opportunities Expansion in emerging markets Expanding vegan market Rising animal meat prices Win customer trust to fuel sales Expand product portfolio | Threats Hampered trust on plant based meat Intensifying competition Economic uncertainty Slowed industry growth Existential threat to Beyond Meat |

6. Recommendations

• Decrease operating expenses by resolving supply chain issues

• Increase presence in Asian region to fuel sales

• Increase plant based meat variety by adding lamb and poultry eggs

• Address customers’ declining trust on product quality through effective communication

• Improve sustainability performance by sharing open and transparent information

• Resolve food safety issues by ensuring hygiene at meat production facilities

7. Concluding remarks

Beyond Meat needs to proactively respond to the changing market environment to remain competitive. Company has potential to fuel the business growth, provided it reduces the rising operating expenses, addresses customers’ quality related concerns, and improves the overall financial health.

8. References

Time. (2021, April 27). 2021 TIME100 Most Influential Companies.

Beyond Meat Number of Employees 2017-2022 | BYND. (n.d.). MacroTrends.

Topic: Beyond Meat Inc. (2022, December 5). Statista.

Beyond Meat® Reports Third Quarter 2022 Financial Results | Beyond Meat, Inc. (n.d.). Beyond Meat, Inc.

Beyond Meat Research and Development Expenses 2017-2022 | BYND. (n.d.). MacroTrends.

Statista. (2022d, December 13). Beyond Meat brand profile in the United States 2022.

Statista. (2022e, December 13). Beyond Meat brand profile in the United States 2022.

Statista. (2022f, December 13). Beyond Meat brand profile in the United States 2022.

Beyond Meat Revenue 2017-2022 | BYND. (n.d.). MacroTrends.

Durant, R. (2022, October 6). Beyond Meat: Growth Is Needed. Seeking Alpha.

TechCrunch is part of the Yahoo family of brands. (2022, October 14).

Kalogeropoulos, D. (2022, December 14). Where Will Beyond Meat Stock Be in 1 Year? The Motley Fool.

Shanker, D. (2022, November 21). Beyond Meat Plant’s Dirty Conditions Revealed in Photos, Documents. Bloomberg.com.

Trainer, D. (2020, September 14). Competition Will Eat Beyond Meat Alive. Forbes.

Trainer, D. (2020b, September 14). Competition Will Eat Beyond Meat Alive. Forbes.

Creswell, J. (2021, November 5). Plant-Based Food Companies Face Critics: Environmental Advocates. The New York Times.

Company ESG Risk Rating – Sustainalytics. (n.d.). sustainalytics.com.

Wong, S. (2021, October 29). Study finds greater demand for meat alternatives in Asia –. Global Coffee Report.

Vegan Food Market Size, Share, Trends | Report 2022 to 2030. (n.d.).

Reporter, A. K. C. (2022, September 22). Report: Beef prices to rise 15% in 2023, poultry costs will fall. Restaurant Dive.

Bloomberg News. (2022, September 27). Once-hot plant-based meat sales decline on price and “woke” status. Financialpost.

De Oca, C. M. (2022, March 24). A deeper dive into plant-based meat sales in 2021 – The Good Food Institute. The Good Food Institute.

Curran, K. P. (2022, May 13). Beyond Meat price target slashed due to “existential threats” to business. Seeking Alpha.